Give your clients a 401(k) that's easy and affordable.

- Payroll Integrations.

Betterment is integrated with commonly used payroll providers to help streamline administrative processes. - Better outcomes.

Give your clients a 401(k) plan to support employees' retirement goals—with an intuitive platform that lets them see all their financial goals in one place. - Fiduciary support.

Betterment acts as both 3(16) administrative and 3(38) investment fiduciary, significantly reducing employer obligations.

Our 401(k) adds value to your practice without more hassle.

-

Deepen relationships.

You can present our investment philosophy with confidence, without having to select and monitor funds or build and manage portfolios.

-

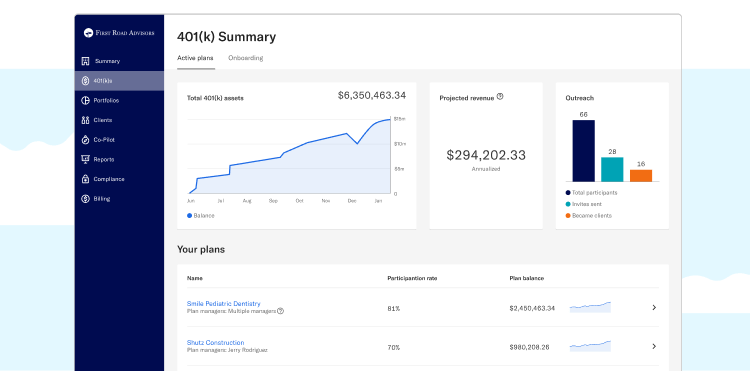

Attract new clients.

Access to plan data along with our customizable email feature enables you to invite employees to become clients of your advisory practice. -

Easy billing.

We collect the AUM fee you agree upon with your client and send it to you on a quarterly basis.