Betterment Editors

Meet our writer

Betterment Editors

The editorial staff at Betterment aims to keep the Resource Center up to date with our evolving approach to financial advice, our product offerings, and new research. Articles attributed to the editorial staff may have originally been published under other Betterment team members or contributors. Read more detail on the Betterment Resource Center.

Articles by Betterment Editors

-

![]()

401(k) Considerations for Highly Compensated Employees

Help ensure your 401(k) plan benefits every employee – from senior executives to ...

401(k) Considerations for Highly Compensated Employees Help ensure your 401(k) plan benefits every employee – from senior executives to entry-level workers. Read on for more information. Smart savers 401(k) considerations for highly compensated employees A 401(k) plan should help every employee – from senior executives to entry-level workers – save for a more comfortable future. To help ensure highly compensated employees (HCEs) don’t gain an unfair advantage through the 401(k) plan, the IRS implemented certain rules that all plans must follow. Wondering how to navigate these special considerations for HCEs? Read on for answers to commonly asked questions. 1. What is an HCE? According to the IRS, an HCE is an individual who: Owned more than 5% of the interest in the business at any time during the year or the preceding year, regardless of how much compensation that person earned or received, or Received compensation from the business of more than $135,000 (if the preceding year is 2022), and, if the employer so chooses, was in the top 20% of employees when ranked by compensation. 2. Why are there special considerations for HCEs? Does your plan offer a company match? If so, consider this example: Joe is a senior manager earning $200,000 a year. He can easily afford to max out his 401(k) plan contributions and earn the full company match (dollar-for-dollar up to 6%). Thomas is an entry-level administrative assistant earning $35,000 a year. He can only afford to contribute 2% of his paycheck to the 401(k) plan, and therefore, isn’t eligible for the full company match. Not only that, Joe can contribute more – and earn greater tax benefits – than Thomas. It doesn’t seem fair, right? The IRS doesn’t think so either. To ensure HCEs don’t disproportionately benefit from the 401(k) plan, the IRS requires annual compliance tests known as non-discrimination tests. 3. What is non-discrimination testing? In order to retain tax-qualified status, a 401(k) plan must not discriminate in favor of key owners and officers, nor highly compensated employees. This is verified annually by a number of tests, which include: Coverage tests – These tests review the ratio of HCEs benefitting from the plan (i.e., of employees considered highly compensated, what percent are benefiting) against the ratio of non-highly compensated employees (NHCEs) benefiting from the plan. Typically, the NHCE percentage benefiting must be at least 70% or 0.7 times the percentage of HCEs considered benefiting for the year, or further testing is required. These tests are performed across employee contributions, matching, and after-tax contributions, and non-elective (employer, non-matching) contributions. ADP and ACP tests – The Actual Deferral Percentage (ADP) Test and the Actual Contribution Percentage (ACP) Test help to ensure that HCEs are not saving significantly more than the employee base. The tests compare the average deferral (traditional and Roth) and employer contribution (matching and after-tax) rates between HCEs and NHCEs. Top-heavy test – A plan is considered top-heavy when the total value of the Key employees’ plan accounts is greater than 60% of the total value of the plan assets. (The IRS defines a key employee as an officer making more than $200,000 (in 2022 and indexed each year after), an owner of more than 5% of the business, or an owner of more than 1% of the business who made more than $150,000 during the plan year.) 4. What if my plan doesn’t pass non-discrimination testing? You may be surprised to learn that it’s actually easier for large companies to pass the tests because they have many employees at varying income levels contributing to the plan. However, small and mid-size businesses may struggle to pass if they have a relatively high number of HCEs. If HCEs contribute a lot to the plan, but NHCEs don’t, there’s a chance that the 401(k) plan will not pass nondiscrimination testing. If your plan fails, you’ll need to fix the imbalance by returning 401(k) plan contributions to your HCEs or increasing contributions to your NHCEs. If you have to refund contributions, affected employees may fall behind on their retirement savings—and that money may be subject to state and federal taxes! Not to mention the fact that you may upset several top employees, which could have a detrimental impact on employee satisfaction and retention. 5. How can I avoid this headache-inducing situation? If you want to bypass compliance tests, consider a safe harbor 401(k) plan. A safe harbor plan is like a typical 401(k) plan except it requires you to: Contribute to the plan on your employees’ behalf, sometimes as an incentive for them to save in the plan Ensure the mandatory employer contribution vests immediately – rather than on a graded or cliff vesting schedule – so employees can always take these contributions with them when they leave To fulfill safe harbor requirements, you can elect one of the following employer contribution formulas: Basic safe harbor match—Employer matches 100% of employee contributions, up to 3% of their compensation, plus 50% of the next 2% of their compensation Enhanced safe harbor match—Employer matches 100% of employee contributions, up to 4% of their compensation. Non-elective contribution—Employer contributes at least 3% of each employee’s compensation, regardless of whether they make their own contributions. Want to contribute more? You absolutely can – the above percentages are only the minimum required of a safe harbor plan. 6. How can a safe harbor plan benefit my top earners? With a safe harbor 401(k) plan, you can ensure that your HCEs will be able to max out your retirement contributions (without the fear that contributions will be returned if the plan fails nondiscrimination testing). 7. What are the upsides (and downsides) of a safe harbor plan? Beyond ensuring your HCEs can max out their contributions, a safe harbor plan can help you: Attract and retain top talent—Offering your employees a matching or non-elective contribution is a powerful recruitment tool. Plus, an employer contribution is a great way to reward your current employees (and incentivize them to save for their future). Improve financial wellness—Studies show that financial stress impacts employees’ ability to focus on work. By helping your employees save for retirement, you help ease that burden and potentially improve company productivity and profitability. Save time and stress—Administering your 401(k) plan takes time—and it can become even more time-consuming and stressful if you’re worried that your plan may not pass nondiscrimination testing. Bypass certain tests altogether by electing a safe harbor 401(k). Reduce your taxable income—Like any employer contribution, safe harbor contributions are tax deductible! Plus, you can receive valuable tax credits to help offset the costs of your 401(k) plan. Of course, these benefits come with a cost; specifically the expense of increasing your overall payroll by 3% or more. So be sure to evaluate whether your company has the financial capacity to make employer contributions on an annual basis. 8. Are there other ways for HCEs to save for retirement? If you decide against a safe harbor plan, you can always encourage your HCEs to take advantage of other retirement-saving avenues, including: Health savings account (HSA) – If your company offers an HSA – typically available to those enrolled in a high-deductible health plan (HDHP) – individuals can contribute up to $3,650, families can contribute up to $7,300, and employees age 55 or older can contribute an additional $1,000 in 2022. The key benefits are: Contributions are tax free, earnings grow tax-free, and funds can be withdrawn tax-free anytime they’re used for qualified health care expenses. The HSA balance carries over and has the potential to grow unlike a “use-it-or-lose-it” FSA. Once employees turn 65, they can withdraw money from an HSA for any purpose – not just medical expenses – without penalty. However, they will have to pay income tax, so they may want to consider reserving it for medical expenses in retirement. Traditional IRA – If employees make after-tax contributions to a traditional IRA, all earnings and growth are tax-deferred. For 2022, the IRA contribution maximum is $6,000 and employees age 50 or older can make an additional $1,000 catch-up contribution. Roth IRA – HCEs may still be eligible to contribute to a Roth IRA, since Roth IRAs have their own separate income limits. But even if an employee’s income is too high to contribute to a Roth IRA, they may be able to convert a Traditional IRA into a Roth IRA via the “backdoor” IRA strategy. To do so, they would make non-deductible contributions to their Traditional IRA, open a Roth IRA, and perform a Roth IRA conversion. This is a more advanced strategy, so for more information, your employees should consult a financial advisor. Taxable Account – A taxable account is a great way to save beyond IRS limits. If employees are maxed out their 401(k) and IRA and want to keep saving, they can invest extra cash in a taxable account. Want to learn more? Betterment can help. Helping HCEs navigate retirement planning can be a challenge. If you’re considering a safe harbor plan or want to explore new ways to enhance retirement savings for all your employees, talk to Betterment today. Betterment assumes no responsibility or liability whatsoever for the content, accuracy, reliability or opinions expressed in a third-party website, to which a published article links (a “linked website”) and such linked websites are not monitored, investigated, or checked for accuracy or completeness by Betterment. It is your responsibility to evaluate the accuracy, reliability, timeliness and completeness of any information available on a linked website. All products, services and content obtained from a linked website are provided “as is” without warranty of any kind, express or implied, including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, title, non-infringement, security, or accuracy. If Betterment has a relationship or affiliation with the author or content, it will note this in additional disclosure. -

![]()

Related Companies and Controlled Groups: What this means for 401(k) plans

When companies are related, how to administer 401(k) plans will depend on the exact ...

Related Companies and Controlled Groups: What this means for 401(k) plans When companies are related, how to administer 401(k) plans will depend on the exact relationship between companies and whether or not a controlled group is deemed to exist. Understanding Controlled Groups Under IRS Code sections 414(b) and (c), a controlled group is a group of companies that have shared ownership and, by meeting certain criteria, can combine their employee bases into one 401(k) plan. The controlled group rules were put into place to ensure that the plan provides proper coverage of employees and that it does not discriminate against non-highly compensated employees. Parent-Subsidiary Controlled Group: When one corporation owns at least an 80% interest in another corporation. The 80% ownership threshold is determined either by owning 80% of the total value of the corporation’s shares of stock or by owning enough stock to hold 80% of the voting power. Brother-Sister Controlled Group: When two or more entities are controlled by the same person or group of people, provided that the following criteria are met: Common ownership: Same five or fewer shareholders own at least an 80% controlling interest in each company. Identical ownership: The same five or fewer shareholders have an identical share of ownership among all companies which, in the aggregate, is more than 50%. In this first example below, a brother-sister controlled group exists between Company A and Company B since the three owners together own more than 80% of Companies A and B, and their identical ownership is 75%. Owner Company A Company B Identical Ownership Mike 15% 15% 15% Tory 40% 50% 40% Megan 40% 20% 20% Total 95% 85% 75% In this second example below, a brother-sister controlled group does not exist between Company A and Company B since the identical ownership is only 15%, well below the required 50% threshold. Owner Company A Company B Company C Identical Ownership Jon 100% 15% 15% 15% Sarah 0% 40% 50% 0% Chris 0% 40% 20% 0% Total 100% 95% 85% 15% Combined Controlled Group: More complicated controlled group structures might involve a parent/subsidiary relationship as well as one or more brother/sister relationship. Three or more companies may constitute a combined controlled group if each is a member of a parent-subsidiary group or brother-sister group and one is: A common parent company included in a parent-subsidiary group and Is also included in a brother-sister group of companies. In the below example, we see that Company A and B are in a brother-sister controlled group as the common ownership for both are at least 80% and the identical ownership is greater than 50%. However, since Company B also owns 100% of Company C, there’s a parent-subsidiary controlled group, which results in a combined controlled group situation. Owner Company A Company B Company C Identical Ownership Ariel 80% 85% 80% Company B 100% Controlled groups and 401(k) plans If related companies are determined to be part of a controlled group, then employers of that controlled group are considered a single employer for purposes of 401(k) plan administration. So even if multiple 401(k) plans exist among the employers within a single controlled group, they must meet the requirements as if they were a single-employer for purposes of: Determining eligibility Determining HCEs ADP & ACP testing Coverage testing Top heavy testing Compensation and contribution limits Vesting determination Maximum contribution and benefit limits Given the complexities associated with controlled group rules and how it may impact 401(k) plan administration, we encourage companies that have questions related to controlled groups to consult with their attorney or tax accountant, as Betterment is not a licensed tax advisor. Betterment assumes no responsibility or liability whatsoever for the content, accuracy, reliability or opinions expressed in a third-party website, to which a published article links (a “linked website”) and such linked websites are not monitored, investigated, or checked for accuracy or completeness by Betterment. It is your responsibility to evaluate the accuracy, reliability, timeliness and completeness of any information available on a linked website. All products, services and content obtained from a linked website are provided “as is” without warranty of any kind, express or implied, including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, title, non-infringement, security, or accuracy. If Betterment has a relationship or affiliation with the author or content, it will note this in additional disclosure. -

![]()

True-Ups: What are they and how are they determined?

You've been funding 401(k) matching contributions, but you just learned you must make an ...

True-Ups: What are they and how are they determined? You've been funding 401(k) matching contributions, but you just learned you must make an additional “true-up” contribution. What does this mean and how was it determined? Employer matching contributions are a great benefit and can help attract and retain employees. It’s not unusual for employers to fund matching contributions each pay period, even though the plan document requires that the matching contribution be calculated on an annualized basis. This means that the matching contribution will need to be calculated both ways (pay period versus annualized) and may result in different matching contribution amounts to certain participants, especially those whose contribution amounts varied throughout the year. For many employers (and payroll systems), the per-pay-period matching contribution method can be easier to administer and help with company cash flow. Employer matching contributions are calculated based on each employee’s earnings and contributions per pay period. However, this method can create problems for employees who max out their 401(k) contributions early, as we will see below. Per-pay-period match: Consistent 401(k) contributions throughout the year Suppose a company matches dollar-for dollar-on the first 4% of pay and pays employees twice a month for a total of 24 pay periods in a year. The per period gross pay of an employee with an annual salary of $120,000, then, is $5,000. If the employee makes a 4% contribution to their 401(k) plan, their $200 per pay period contribution will be matched with $200 from the company. Per-pay-period matching contribution methodology for $120K employee contributing 4% for full year Employee contribution Employer matching contribution Total Contributions per pay period $200 $200 $400 Full year contributions $4,800 $4,800 $9,600 For the full year, assuming the 401(k) contribution rate remains constant, this employee would contribute a total of $4,800 and receive $4,800 from their employer, for a total of $9,600. Per-pay-period match: Maxing out 401(k) contributions early Employees are often encouraged to optimize their 401(k) benefit by contributing the maximum allowable amount to their plan. Suppose instead that this same employee is enthusiastic about this suggestion and, determined to maximize their 401(k) contribution, elects to contribute 20% of their paycheck to the company’s 401(k) plan. Sounds great, right? At this rate, however, assuming the employee is younger than age 50, the employee would reach the $19,500 annual 401(k) contribution limit during the 20th pay period. Their contributions to the plan would stop, but so too would the employer matching contributions, even though the company had only deposited $3,800 into this employee’s account, — $1,000 less than the amount that would have been received if the employee had spread their contributions throughout the year and received the full matching contribution for every pay period. Per-pay-period matching contribution methodology for $120K employee contributing 20% from beginning of year Employee contribution Employer matching contribution Total Contributions per pay period $1,000 $200 $1,200 Full year contributions $19,500 $3,800 $23,300 Employees who max out too soon on their own contributions are at risk of missing out on the full employer matching contribution amount. This can happen if the contribution rate or compensation (due to bonuses, for instance) varies throughout the year. True-up contributions using annualized matching calculation When the plan document stipulates that the matching contribution calculation will be made on an annualized basis, plans who match each pay period will be required to make an extra calculation after the end of the plan year. The annualized contribution amount is based on each employee’s contributions and compensation throughout the entire plan year. The difference between these annualized calculations and those made on a per-pay-period basis will be the “true-up contributions” required for any employees who maxed out their 401(k) contributions early and therefore missed out on the full company matching contribution. In the example above, the employee would receive a true-up contribution of $1,000 in the following year. Plans with the annualized employer matching contribution requirement (per their plan document) may still make matching contributions each pay period, but during compliance testing, which is based on annual compensation, matching amounts are reviewed and true-ups calculated as needed. The true-up contribution is normally completed within the first two months following the plan year end and before the company’s tax filing deadline. Making true-up contributions means employees won’t have to worry about adjusting their contribution percentages to make sure they don’t max out too early. Employees can front-load their 401(k) contributions and still receive the full matching contribution amount. Often true-up contributions affect senior managers or business owners; hence companies are reluctant to amend their plan to a per-pay-period matching contribution calculation. That said, employers should be prepared to make true-up contributions and not be surprised when they are required. -

![]()

401(k) QNECs & QMACs: what are they and does my plan need them?

QNECs and QMACs are special 401(k) contributions employers can make to correct certain ...

401(k) QNECs & QMACs: what are they and does my plan need them? QNECs and QMACs are special 401(k) contributions employers can make to correct certain compliance errors without incurring IRS penalties. Even the best laid plans can go awry, especially when some elements are out of your control. Managing a 401(k) plan is no different. For example, your plan could fail certain required nondiscrimination tests depending solely on how much each of your employees chooses to defer into the plan for that year (unless you have a safe harbor 401(k) plan that is deemed to pass this testing) QNECs and QMACs are designed to help employers fix specific 401(k) plan problems by making additional contributions to the plan accounts of employees who have been negatively affected. What is a QNEC? A Qualified Nonelective Contribution (QNEC) is a contribution employers can make to the 401(k) plan on behalf of some or all employees to correct certain types of operational mistakes and failed nondiscrimination tests. They are typically calculated based on a percentage of an employee’s compensation. QNECs must be immediately 100% vested when allocated to participants’ accounts. This means they are not forfeitable and cannot be subject to a vesting schedule. QNECs also must be subject to the same distribution restrictions that apply to elective deferrals in a 401(k) plan. In other words, QNECs cannot be distributed until the participant has met one of the following triggering events: severed employment, attained age 59½, died, become disabled, or met the requirements for a qualified reservist distribution or a financial hardship (plan permitting). These assets may also be distributed upon termination of the plan. What is a QMAC? A Qualified Matching Contribution (QMAC) is also an employer contribution that may be used to assist employers in correcting problems in their 401(k) plan. The QMAC made for a participant is a matching contribution, based on how much the participant is contributing to the plan (as pre-tax deferrals, designated Roth contributions, or after-tax employee contributions), or it may be based on the amount needed to bring the plan into compliance, depending on the problem being corrected. QMACs also must be nonforfeitable and subject to the distribution limitations listed above when they are allocated to participant’s accounts. QNECs vs. QMACs Based on % of employee’s compensation based on amount of employee’s contribution QNECs (Qualified Nonelective Contribution) QMACs (Qualified Matching Contribution) Commonly used to pass either the Actual Deferral Percentage (ADP) or Actual Contribution Percentage (ACP) test Most commonly used to pass the Actual Contribution Percentage (ACP) test Frequently Asked Questions about QNECs and QMACs How are QNECs and QMACs used to correct nondiscrimination testing failures? One of the most common situations in which an employer might choose to make a QNEC or QMAC is when their 401(k) plan has failed the Actual Deferral Percentage (ADP) test or the Actual Contribution Percentage (ACP) test for a plan year. These tests ensure the plan does not disproportionately benefit highly compensated employees (HCEs). The ADP test limits the percentage of compensation the HCE group can defer into the 401(k) plan based on the deferral rate of the non-HCE group. The ACP test ensures that the employer matching contributions and after-tax employee contributions for HCEs are not disproportionately higher than those for non-HCEs. When the plan fails one of these tests at year-end, the employer may have a few correction options available, depending on their plan document. Many plans choose to distribute excess deferrals to HCEs to bring the HCE group’s deferral rate down to a level that will pass the test. Your HCEs, however, may not appreciate a taxable refund at the end of the year or a cap on how much they can save for retirement. Making QNECs and QMACs are another option for correcting failed nondiscrimination tests. This option allows HCEs to keep their savings in the plan because the employer is making additional contributions to raise the deferral or contribution rate of the lower paid employees (non-HCEs) to a level that passes the test. How much would I have to contribute to correct a testing failure? For QNECs, the plan usually allows the employer to contribute the minimum QNEC amount needed to boost the non-HCE group’s deferral rate enough to pass the ADP test. The contribution formula may require that an allocation be a specific percentage of compensation that will be given equally to all non-HCEs, or it may allow the allocation to be used in a more targeted fashion that gives the amount needed to pass the test to just certain non-HCEs. QMACs are most commonly made to pass the ACP test. As with QNECs, there are allocation options available to the plan sponsor when making QMACs. A plan sponsor can make targeted QMACs, which are an amount needed to satisfy a nondiscrimination testing failure, or they can allocate QMACs based on the percentage of compensation deferred by a participant. QNECs and QMACs can both be made to help pass the ADP and ACP tests, but a contribution cannot be double counted. For example, if a QNEC was used to help the plan pass the ADP test, that QNEC cannot also be used to help pass the ACP test. How long do I have to make a QNEC or QMAC to correct a testing failure? QNECs/QMACs used to correct ADP/ACP tests generally must be made within 12 months after the end of the plan year being tested. Beware, however, if you use the prior-year testing method for your ADP/ACP tests. If you use this testing method, the QNEC/QMAC must be made by the end of the plan year being tested. For example, if you’re using the prior-year testing method for the 2022 plan year ADP test, the non-HCE group’s deferral rate for 2021 is used to determine the passing rate for HCE deferrals for 2022 testing. Using this prior-year method can help plans proactively determine the maximum amount HCEs may defer each year. But, if the plan still fails testing for some reason, a QNEC or QMAC would have to be made by the end of 2022, which is before the ADP/ACP test would be completed for 2022. QNECs and QMACs deposited by the employer’s tax-filing deadline (plus extensions) for a tax year will be deductible for that tax year. What other types of compliance issues may be corrected with a QNEC or QMAC? Through administrative mix-ups or miscommunications with payroll, a plan administrator might fail to recognize that an employee has met the eligibility requirements to enter the plan or fail to notify the employee of their eligibility. These types of errors tend to happen especially in plans that have an automatic enrollment feature. And sometimes, even when the employee has made an election to begin deferring into the plan, the election can be missed. These types of errors are considered a “missed deferral opportunity.” The employer may correct its mistake by contributing to the plan on behalf of the employee. How is a QNEC or QMAC calculated for a “missed deferral opportunity”? When a missed deferral opportunity is discovered, the employer can correct this operational error by making a QNEC contribution up to 50% of what the employee would have deferred based on their compensation for the year and the average deferral rate for the group the employee belongs to (HCE or non-HCE) for the year the mistake occurred. The QNEC must also include the amount of investment earnings that would be attributable to the deferral had it been contributed timely. If a missed deferral opportunity is being corrected and the plan is a 401(k) safe harbor plan, the employer must make a matching contribution in the form of a QMAC to go with the QNEC to make up for the missed deferrals, plus earnings. Is there a way to reduce the cost of QNECs/QMACs? Employers who catch and fix their mistakes early can reduce the cost of correcting a compliance error. For example, no QNEC is required if the correct deferral amount begins for an affected employee by the first payroll after the earlier of 3 months after the failure occurred, or The end of the month following the month in which the employee notified the employer of the failure. Plans that have an automatic enrollment feature have an even longer time to correct errors. No QNEC is required if the correct deferral amount begins for an affected employee by the first payroll after the earlier of 9½ months after the end of the plan year in which the failure occurred, or The end of the month after the month in which the employee notified the employer of the failure. If it has been more than three months but not past the end of the second plan year following the year in which deferrals were missed, a 25% QNEC (reduced from 50%) is sufficient to correct the plan error. The QNEC must include earnings and any missed matching contributions and the correct deferrals must begin by the first payroll after the earlier of: The end of the second plan year following the year the failure occurred, or The end of the month after the month in which the employee notified the employer of the failure. For all these reduced QNEC scenarios, employees must be given a special notice about the correction within 45 days of the start of the correct deferrals. For More Information These rules are complex, and the calculation of the corrective contribution, as well as the deadline to contribute, varies based on the type of mistake being corrected. You can find more information about correcting plan mistakes using QNECs or QMACs on the IRS’s Employee Plans Compliance Resolution System (EPCRS) webpage. And you can contact your Betterment for Business representative to discuss the correction options for your plan. Betterment is not a tax advisor, nor should any information herein be considered tax advice. Please consult a qualified tax professional. Betterment assumes no responsibility or liability whatsoever for the content, accuracy, reliability or opinions expressed in a third-party website, to which a published article links (a “linked website”) and such linked websites are not monitored, investigated, or checked for accuracy or completeness by Betterment. It is your responsibility to evaluate the accuracy, reliability, timeliness and completeness of any information available on a linked website. All products, services and content obtained from a linked website are provided “as is” without warranty of any kind, express or implied, including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, title, non-infringement, security, or accuracy. If Betterment has a relationship or affiliation with the author or content, it will note this in additional disclosure. -

![]()

Key 2023 Deadlines for 401(k) Plan Sponsors

Birthdays, wedding anniversaries … and 401(k) plan compliance deadlines. Some dates are ...

Key 2023 Deadlines for 401(k) Plan Sponsors Birthdays, wedding anniversaries … and 401(k) plan compliance deadlines. Some dates are worth saving more than others. Offering a 401(k) plan has many benefits for both your company and your employees, but keeping your calendar clear of important dates isn’t one of them. Plan sponsors have several responsibilities throughout the year to keep their plan operating in compliance with federal regulations. We’ve summarized a few biggies for 2023—along with the remaining weeks of 2022—below to make your life a little easier. If a deadline falls on a weekend, it’s safest to submit the previous business day unless otherwise noted. Please also keep in mind there may be additional state regulations applicable to your plan not listed here. January February March April May June July August September October November December Remaining of 2022 January Friday, Jan. 13 Betterment at Work loads the prior year census template and compliance questionnaire to plan sponsors’ Compliance Hubs. Plan sponsors have until Tuesday, Jan. 31 to complete and submit both documents. Tuesday, Jan. 31 Betterment at Work makes IRS Forms 1099-R available to participants Send Form W-2 to your employees. Submit Form W-2 to the Social Security Administration. Submit the prior year census data and compliance questionnaire to Betterment at Work. Submit Annual Return of Withheld Federal Income Tax (Form 945) to the IRS. If you’ve made all your deposits on time and in full, then the due date is Friday, Feb. 10. February Wednesday, Feb. 1 Send Form 1099-NEC to both the IRS and your employees. Post the prior year’s OSHA Summary of Illness and Injuries in your workplace between February 1 and March 2. Tuesday, Feb. 28 For Applicable Large Employers (ALE) Submit paper Forms 1094-C and 1095-C to the IRS. If you intend to e-file your forms, then the deadline is Friday, March 31. For self-insured, non-ALE companies Submit paper Forms 1094-B and 1095-B to the IRS. If you intend to e-file your forms, then the deadline is Friday, March 31. Note: Form 1095-B must be filed electronically if the reporting entity is required to file 250 or more returns. March Wednesday, March 15 Make refunds to participants for failed ADP/ACP tests(s), if applicable. As the plan sponsor, you must approve corrective action by your 401(k) provider by this date. Failure to meet this deadline could result in a 10% tax penalty for plan sponsors. For S-Corps and LLCs taxed as Partnerships Employer contributions (e.g., profit sharing, match, Safe Harbor) are due for deductibility. For S-Corps and Partnerships Deadline to establish a traditional (non-Safe Harbor) plan for the prior tax year, unless the tax deadline has been extended. Thursday, March 30 For companies in Connecticut with 5+ employees Deadline to comply with Connecticut’s retirement plan mandate. Friday, March 31 File Form 1099s electronically with the IRS. For companies with 100+ employees Submit your EEO-1 report. April Saturday, April 1 Confirm initial Required Minimum Distributions (RMDs) were taken by participants who turned 72 before previous year-end, are retired/terminated, and have a balance. For companies in Maine with 25+ employees Deadline to comply with Maine’s retirement plan mandate. Tuesday, April 18 Tax Day For C-Corps, LLCs taxed as C-Corps, or sole proprietorships Employer contributions (e.g., profit sharing, match, Safe Harbor) are due for deductibility. For C-Corps and Sole Props Deadline to establish a traditional (non-Safe Harbor) plan for the prior tax year, unless the tax deadline has been extended. May Monday, May 1 File Form 941 (Employer’s Quarterly Federal Tax Return) with the IRS. Monday, May 15 For non-profit companies Tax returns due June N/A July Saturday, July 1 For companies in Virginia with 25+ employees Deadline to comply with Virginia’s retirement plan mandate. Monday, July 10 Mid-Year Benefits Review: Remind employees to take advantage of any eligible voluntary benefits. Saturday, July 29 If your plan was amended, this is the deadline to distribute Summary of Material Modifications (SMM) to participants. Sunday, July 30 For self-insured companies Submit the PCORI fee to the IRS. Monday, July 31 File Form 941 (Employer’s Quarterly Federal Tax Return) with the IRS. Electronically submit Form 5500 (and third-party audit, if applicable) OR request an extension (Form 5558). Betterment at Work prepares these forms on our plan sponsors’ behalf, with plan sponsors being responsible for filing them electronically. August Tuesday, Aug. 1 For *new* Betterment 401(k) plans Deadline to sign a services agreement with Betterment at Work in order to establish a new Safe Harbor 401(k) plan for 2024. Deferrals must be started by Sunday, Oct. 1. September Friday, Sept. 15 For S-Corps and Partnerships Deadline to establish a traditional (non-Safe Harbor) plan for the prior tax year if the tax deadline has been extended. Saturday, Sept. 30 Distribute Summary Annual Report (SAR) to your participants and beneficiaries. If a Form 5500 extension is filed, then the deadline to distribute is Friday, Dec. 15. October Sunday, Oct. 1 Deadline to establish a new Safe Harbor 401(k) plan. The plan must have deferrals for at least 3 months to be Safe Harbor for this plan year. For companies in Maine with 15-24 employees Deadline to comply with Maine’s retirement plan mandate. Sunday, Oct. 15 For C-Corps and Sole Props Deadline to establish a traditional (non-Safe Harbor) plan for the prior tax year if the tax deadline has been extended. For companies that offer prescription drug coverage to Medicare-eligible employees Notify Medicare-eligible enrollees of creditable coverage for prescription drugs. Monday, Oct. 16 Electronically submit Form 5500 (and third-party audit if applicable) if granted a Form 5558 extension. Betterment at Work prepares these forms on our plan sponsors’ behalf, with plan sponsors being responsible for filing them electronically. Tuesday, Oct. 31 File Form 941 (Employer’s Quarterly Federal Tax Return) with the IRS. November Wednesday, Nov. 1 For companies in Illinois with 5+ employees Deadline to comply with Illinois’ retirement plan mandate. Thursday, Nov. 2 If you’re adopting a new 401(k) plan for 2024, this is the deadline to notify SIMPLE IRA participants (if applicable) that their plan will terminate January 1. A company cannot sponsor a SIMPLE IRA and a 401(k) plan at the same time. December Friday, Dec. 1 Betterment at Work prepares 2024 Annual Notices (listed below) and sends relevant notices to our plan sponsors for distributing to participants. Plan sponsors to disseminate paper copies if required. Deadline for plan sponsors to distribute notices (if applicable) to participants for 2024 plan year: Safe Harbor notice Qualified Default Investment Alternative (QDIA) notice Automatic Enrollment notice Deadline to execute amendment to make a traditional plan a 3% Safe Harbor nonelective plan for the 2023 plan year. Deadline to execute amendment to make a traditional plan a Safe Harbor match plan for the 2024 plan year. Friday, Dec. 15 Distribute Summary Annual Report (SAR) to participants, if granted a Form 5558 extension. Sunday, Dec. 31 Post required workplace notices in conspicuous locations. Deadline to execute amendment to make a traditional plan a 4% Safe Harbor nonelective plan for the 2022 plan year. Deadline to make Safe Harbor and other employer contributions for 2022 plan year. Deadline for annual Required Minimum Distributions (RMDs). For companies that failed ADP/ACP compliance testing Deadline to distribute ADP/ACP refunds for the prior year; a 10% excise will apply. Deadline to fund a QNEC for plans that failed ADP/ACP compliance testing. Remaining 2022 Deadlines Thursday, Dec. 1, 2022 Betterment at Work prepares 2023 Annual Notices (listed below) and sends relevant notices to our plan sponsors for distributing to participants. Plan sponsors to disseminate paper copies if required. Deadline for plan sponsors to distribute notices (if applicable) to participants for 2024 plan year: Safe Harbor notice Qualified Default Investment Alternative (QDIA) notice Automatic Enrollment notice Deadline to execute amendment to make traditional plan a 3% safe harbor nonelective plan for the 2022 plan year. Deadline to execute amendment to make a traditional plan a safe harbor match plan for the 2023 plan year. Thursday, Dec. 15, 2022 Deadline to distribute Summary Annual Report (SAR) to participants, if granted a Form 5558 extension. Saturday, Dec. 31, 2022 Deadline to distribute ADP/ACP refunds for the prior year; a 10% excise will apply Deadline to fund a QNEC for plans that failed ADP/ACP compliance testing. Deadline to execute amendment to make traditional plan a 4% safe harbor nonelective plan for the 2021 plan year. Deadline to make safe harbor and other employer contributions for 2021 plan year. Deadline for Annual Required Minimum Distributions (RMDs). -

![]()

Add a Friendly Face to Your Employees’ 401(k)s

Why some of your 401(k) plan’s participants may need a little extra advice—and how to ...

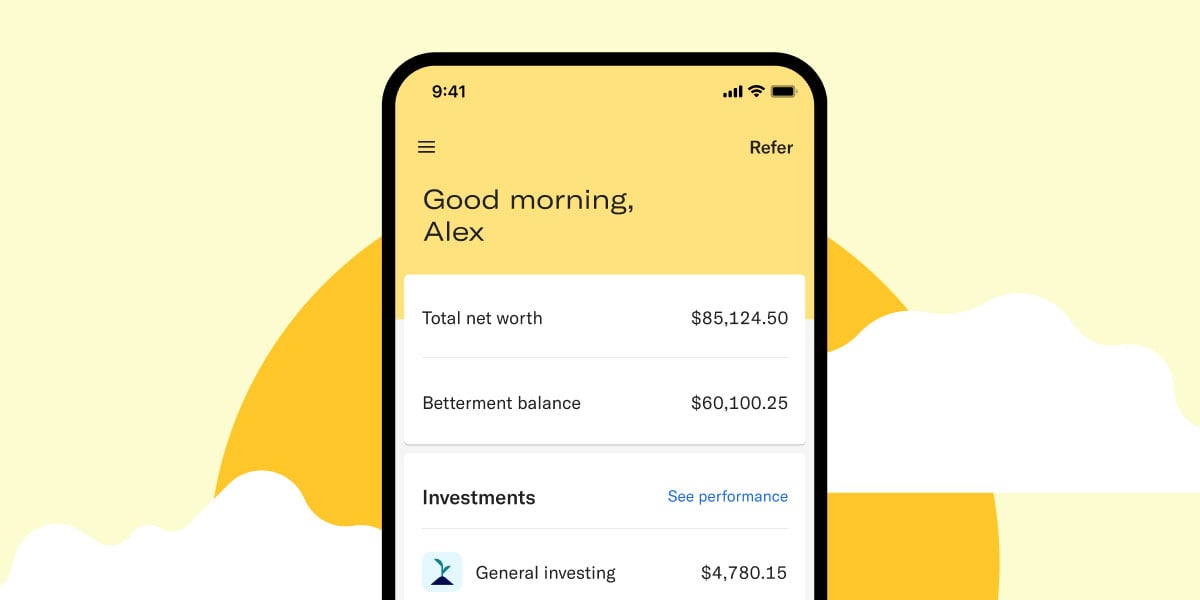

Add a Friendly Face to Your Employees’ 401(k)s Why some of your 401(k) plan’s participants may need a little extra advice—and how to give it to them. Before our arrival more than a decade ago, the finance world typically worked one way for everyday investors: you had a “guy.” In rare cases—much too rare—it was a “gal,” but that’s a story for another day. This advisor may or may not have been a fiduciary, meaning someone legally obligated to act in your best interest. But if you wanted to invest, you had to go through them. And they likely charged a hefty sum for their services, given that today’s average fees for a traditional financial advisor are still more expensive than alternatives like Betterment. Something about this dynamic didn’t sit well with us, so we flipped the relationship on its head. We put our team of experts to work behind the scenes. Traders and tax experts, behavioral scientists and “quants,” they all worked together to infuse technology with their investing insights, leading to a piece of software that served up personalized advice and automated features at scale and for a fraction of the cost of what most investment firms charged. While plenty of investors—730,000 and counting—utilize our approach to automated investing, some still prefer to add a human advisor to that experience, someone to coach them through their money moves face-to-face. And you know what? We not only think that arrangement is okay, it sums up our investing philosophy well: automate what you can, and leave the rest to humans. The implications for your company’s 401(k) plan All of the above holds true for your employees and their 401(k)s. You can give them an intuitive platform to automate their retirement savings. You can match a percentage of their contributions as an incentive. You can share a robust library of educational resources to help explain investing. Some will thrive in this scenario, some will struggle, and some may not bother to sign up at all. So what are you, the plan sponsor, to do? Well, you can add Certified Coaching to your Betterment at Work 401(k), giving your employees access to professional financial advice from our team of CERTIFIED FINANCIAL PLANNER™ professionals. These experts—all fiduciaries, by the way—add a warm touch to the cold arithmetic of retirement saving. They can help your employees not only maximize their 401(k)s, but sort through the rest of their financial lives. “You know, the biggest emotion I sense from clients after a session isn’t excitement; it’s a sense of relief,” says Corbin Blackwell, one of our advisors. “They’re smart people, but investing is scary. Sometimes you just need reassurance that you’re on the right track.” Or sometimes, your employees really do have unusual life circumstances that make for complicated financial decisions. The sort of scenarios that aren’t easy to automate. Maybe they’re high earners, for example, trying to weigh the pros and cons of a Roth IRA conversion. In any case, it’s helpful to have a CFP® professional like Corbin available to talk with. Giving your employees this premium resource can help boost your plan’s participation rate and may improve their financial wellbeing. It can also elevate your 401(k) above your competitors. Retirement saving’s role in the recruiting arms race So far we’ve focused on the benefits of Certified Coaching to your existing employees. We haven’t touched on the appeal to prospective employees, the people you’re hoping fill your talent pipeline for years to come. To some of these workers, a 401(k) is an expectation and neither a surprise nor a delight. They’ve seen plenty of cookie cutter retirement benefits in past jobs and none stood out, at least for the right reasons. While some companies consider this business as usual, another box to check in their benefits package, others see an advantage just waiting to be taken. Because let’s be real, what actually stands out: a piece of paper in your benefits packet, or real-time access to an expert like Corbin? Don’t take our word for it, listen to the recruits. We surveyed workers—and 1-in-5 said access to a live financial advisor could entice them to leave their current job. Whether you’re already a Betterment at Work customer or considering becoming one, Certified Coaching carries the potential to differentiate not only your 401(k) plan but your company. It’s a straightforward way to show you care about the financial well-being of recruits and current employees alike. -

![]()

The Case for Including ETFs and managed portfolios in Your 401(k) Plan

At Betterment, we firmly believe exchange-traded funds (ETFs) are better for 401(k) plan ...

The Case for Including ETFs and managed portfolios in Your 401(k) Plan At Betterment, we firmly believe exchange-traded funds (ETFs) are better for 401(k) plan participants. Wondering if managed ETF portfolios may be appropriate for your plan? Mutual funds dominate the retirement investment landscape, but in recent years, exchange-traded funds (ETFs) have become increasingly popular—and for good reason. They are cost-effective, highly flexible, and technologically sophisticated. And at Betterment, we firmly believe they’re also better for 401(k) plan participants. Wondering if ETFs may be appropriate for your 401(k) plan? Read on. What’s the difference between mutual funds and ETFs? Let’s start with what ETFs and mutual funds have in common. Both consist of a mix of many different assets, which helps investors diversify their portfolios. However, they have a few key differences: ETFs can be traded like stocks whereas mutual funds may only be purchased at the end of each trading day based on a calculated price. ETFs are transparent meaning you can see the underlying holdings daily. Mutual funds either report its holdings monthly or quarterly. Mutual funds are either actively managed by a fund manager who decides how to allocate assets or passively managed by tracking a specific market index (such as the S&P 500). While ETFs are usually passively managed, more differentiated ETFs that are actively managed or use other fundamentals like factors (smart beta) have emerged over the years. Mutual funds tend to have higher fees and higher expense ratios than ETFs, especially in instances where smaller plans do not have access to institutional share classes. Why do mutual funds cost so much more than ETFs? Many mutual funds are actively managed—requiring in-depth analysis and research—which drives the costs up. However, while active managers claim to outperform popular benchmarks, research conclusively shows that they rarely succeed in doing so. See what we mean. Mutual fund providers generate revenues from both stated management fees, as well as less direct forms of compensation, for example: Revenue sharing agreements—These agreements among 401(k) plan providers and mutual fund companies include: 12(b)-1 fees, which are disclosed in a fund’s expense ratios and are annual distribution or marketing fees Sub Transfer Agent (Sub-TA) fees for maintaining records of a mutual fund’s shareholders Revenue sharing agreements often appear as conflicts of interests. Internal fund trading expenses—The buying and selling of internal, underlying assets in a mutual fund are another cost to investors. However, unlike the conspicuous fees in a fund’s expense ratio, these brokerage expenses are not disclosed and actual amounts may never be known. Instead, the costs of trading underlying shares are simply paid out of the mutual fund’s assets, which results in overall lower returns for investors. Soft-dollar arrangements—These commission arrangements, sometimes called excess commissions, exacerbate the problem of hidden expenses because the mutual fund manager engages a broker-dealer to do more than just execute trades for the fund. These services could include nearly anything—securities research, hardware, or even an accounting firm’s conference hotel costs! All of these costs mean that mutual funds are usually more expensive than ETFs. These higher expenses come out of investors’ pockets. That helps to explain why a majority of actively managed funds lag the net performance of passively managed funds, which lag the net performance of ETFs with the same investment objective over nearly every time period. What else didn’t I realize about mutual funds? Often, there are conflicts of interest with mutual funds. The 401(k) market is largely dominated by players who are incentivized to offer certain funds: Some service providers are, at their core, mutual fund companies. And therefore, some investment advisors are incentivized to promote certain funds. This means that the fund family providing 401(k) services and the advisor who sells the plans may have a conflict of interest. Why is it unusual to see ETFs in 401(k)s? Mutual funds continue to make up the majority of assets in 401(k) plans for various reasons, not despite these hidden fees and conflicts of interest, but because of them. Plans are often sold through distribution partners, which can include brokers, advisors, recordkeepers or third-party administrators. The fees embedded in mutual funds help offset expenses and facilitate payment of every party involved in the sale. However, it’s challenging for employers and employees because the fees aren’t easy to understand even with the mandated disclosure requirements. Another reason why it’s unusual to see ETFs in a 401(k) is existing technology limitations. Most 401(k) recordkeeping systems were built decades ago and designed to handle once-per-day trading, not intra-day trading (the way ETFs are traded)—so these systems can’t handle ETFs on the platform (at all). However, times are changing. ETFs are gaining traction in the general marketplace and companies like Betterment are leading the way by offering ETFs. What’s even better than ETFs? At Betterment, we believe that a portfolio of ETFs in conjunction with personalized, unbiased advice is the ideal solution for today’s retirement savers. Our retirement advice adapts to your employees’ desired retirement timeline and can be customized if they’re more conservative or aggressive investors. Not only that, we also link employees’ outside investments, savings accounts, IRAs—even spousal/partner assets—to create a real-time snapshot of their finances. It can make saving for retirement (and any other short- or long-term goals) even easier. You may be wondering: What about target-date funds? Well, target-date funds are still popular, but financial advice has progressed far beyond using one data point—employees’ desired retirement age—to determine their investing strategy. Here’s how: Target-date funds are only in five-year increments (for example, 2045 Fund or 2050 Fund). Betterment can tailor our advice to the exact year your employees want to retire. Target-date funds ignore how much employees have saved. At Betterment, we can tell your employees if they‘re on or off track, factoring in all of their retirement savings, Social Security, pensions, and more. Target-date funds only contain that company’s underlying investments (for example, Vanguard target-date funds only have Vanguard investments). No single company is the best at every type of investment, so don’t limit your employees’ retirement to just one company’s investments. Now what? You may be thinking: it’s time to have a heart-to-heart with your 401(k) provider or plan’s investment advisor. If so, here’s a list of questions to ask: Do you offer ETFs? If not, why not? What are the fees associated with our funds? Are there revenue sharing agreements in place? Are there any soft-dollar arrangements we should be aware of? Are you incentivized to offer certain funds? Are there any conflicts of interests that we should be aware of? Do you create managed portfolio strategies? -

![]()

The Tax Benefits of Offering a 401(k)

Seize the tax deductions (and credits!). Offering a 401(k) to your employees can unlock ...

The Tax Benefits of Offering a 401(k) Seize the tax deductions (and credits!). Offering a 401(k) to your employees can unlock several tax benefits for your company. When employees contribute to their 401(k) accounts, they unlock some pretty sweet tax perks. But no less important are the potential tax benefits awaiting your own company by virtue of offering a 401(k) in the first place. We’re not a tax advisor, and none of this information should be considered tax advice for your company’s specific situation, but we’d be remiss if we didn’t lay out three key tax benefits awaiting companies in general by sponsoring a 401(k) plan: Company contributions are tax deductible Plan administration fees are (usually) tax deductible Small businesses can snag tax credits for starting a new plan and/or adding auto-enroll Keep reading for more details on each opportunity. Your company’s contributions to employees’ 401(k)s are tax deductible When you contribute to your employees’ 401(k)s, you not only supercharge their retirement savings and boost the appeal of your benefits, you can deduct your contributions from your company’s taxable income, assuming they don’t exceed the IRS’s limit. That annual contribution limit is 25% of compensation paid to eligible employees and doesn’t change from year to year. Compensation Pro-Tip: Consider a contribution over a raise It’s for this reason that dollar-for-dollar, contributing to your employees’ 401(k)s on a pre-tax basis (i.e. via a Traditional 401(k)) is more tax efficient for you and for them compared to giving them raises of an equivalent amount. Consider this example using $3,000: A $3,000 increase in employees’ base pay would mean a net increase to them of just $2,250, assuming 25% in income taxes and FICA combined. For the company, that increase would cost $2,422.12 after FICA adjusted for a 25% income tax rate. You contributing $3,000 to an employee’s 401(k), on the other hand, results in no FICA for both you and them. The employee receives the full benefit of that $3,000 today on a pre-tax basis, plus it has the opportunity to grow tax-free in a Traditional 401(k) until retirement. As the employer, the value of your tax deduction on that $3,000 contribution would be $750, meaning your cost is just $2,250—or 7% less than if you had provided a $3,000 salary increase. Your plan administration fees are (usually) tax deductible Although companies have the option of passing on their plan administration fees to employees—or splitting the tab—many employers opt to pay them entirely. In this case, these costs are typically considered a tax-deductible business expense. The result is a win-win: employees keep more funds invested in their 401(k) accounts and you reduce your company’s taxable income. Small businesses can snag valuable three-year tax credits Thanks to the SECURE Act of 2019, businesses with fewer than 100 employees are eligible for two kinds of valuable three-year tax credits: For opening a new plan—Three years of annual tax credits covering 50% of the cost to establish and administer a retirement savings plan, up to $15,000 over those three years. A new version of the SECURE Act that’s likely to pass soon would increase this credit to 100% for businesses with up to 50 employees. For adding eligible auto-enroll—Three years of annual tax credits worth $500 for adding an eligible auto-enroll feature to your new or existing plan. Even more valuable than a tax deduction, a tax credit subtracts the value from the taxes you owe. -

![]()

Share the Wealth: Everything you need to know about profit sharing 401(k) plans

In addition to bonuses, raises, and extra perks, many employers elect to add profit ...

Share the Wealth: Everything you need to know about profit sharing 401(k) plans In addition to bonuses, raises, and extra perks, many employers elect to add profit sharing to their 401(k) plan. Read on for answers to frequently asked questions. Has your company had a successful year? A great way to motivate employees to keep up the good work is by sharing the wealth. In addition to bonuses, raises, and extra perks, many employers elect to add profit sharing to their 401(k) plan. Wondering if it might be right for your business? Read on for answers to frequently asked questions about profit sharing 401(k) plans. What is profit sharing? Let’s start with the basics. Profit sharing is a way for you to give extra money to your staff. While you could make direct payments to your employees, it’s very common to combine profit sharing with an employer-sponsored retirement plan. That way, you reward your employees—and help them save for a brighter future. What is a profit sharing plan? A profit sharing plan is a type of defined contribution plan that allows you to help your employees save for retirement. With this type of plan, you make “nonelective contributions” to your employees’ retirement accounts. This means that each year, you can decide how much cash (or company stock, if applicable) to contribute—or whether you want to contribute at all. It’s important to note that the name “profit sharing” comes from a time when these plans were actually tied to the company’s profits. Nowadays, companies have the freedom to contribute what they want, and they don’t have to tie their contributions to the company’s annual profit (or loss). In a pure profit sharing plan, employees do not make their own contributions. However, most companies offer a profit sharing plan in conjunction with a 401(k) plan. What is a profit sharing 401(k) plan? A 401(k) with profit sharing enables both you and your employees to contribute to the plan. Here’s how it works: The 401(k) plan allows employees to make their own salary deferrals up to the IRS limit. The profit sharing component allows employers to contribute up to the IRS limit, noting that the maximum includes the employee's contributions as well. After the end of the year, employers can make their pre-tax profit sharing contribution, as a percentage of each employee’s salary or as a fixed dollar amount Employers determine employee eligibility, set the vesting schedule for the profit sharing contributions, and decide whether employees can select their own investments (or not) What’s the difference between profit sharing and an employer match? Profit sharing and employer matching contributions seem similar, but they’re actually quite different: Employer match—Employer contributions that are tied to employee savings up to a certain percentage of their salary (for example, 50 cents of every dollar saved up to 6% of pay) Profit sharing—An employer has the flexibility to choose how much money—if any at all—to contribute to employees’ accounts each year; the amount is not tied to how much employees save. What kinds of profit sharing plans are there? There are four main types of profit sharing plans: Pro-rata plan—Every plan participant receives employer contributions at the same rate. For example, every employee receives the equivalent of 5% of their salary or every employee receives a flat dollar amount such as $1,000. Why is it good? It’s simple and rewarding. New comparability profit sharing plan (otherwise known as “cross-tested plans”)—Employees are placed into separate benefit groups that receive different profit sharing amounts. For example, business owners (or other highly compensated employees) are in one group that receives the maximum contribution and all other employees are in another group and receive a lower amount. Why is it good? It offers older owners the most flexibility. Minimum Gateway – In order to utilize new comparability, the plan must satisfy the Minimum Gateway Contribution – All non-highly compensated employees (NHCEs) must receive an allocation that is no less than the lesser of 5% of the participant's gross compensation, or 1/3 of the highest contribution rate given to any highly compensated employees (HCEs). General Test – Once the minimum gateway is passed, it must pass the general test which breaks up the plan into “rate groups” based on their Equivalent benefit Accrual Rate (EBAR). Every HCE is in their separate rate group, which includes all participants who have an EBAR equal to or greater than that HCE. If the ratio percentage for each rate group is 70% or higher, the plan passes, and no further testing is necessary. If each rate group does not satisfy the ratio percentage test, then we revert to using the average benefits test. The average benefits test is the more complicated test, and consists of two parts: the nondiscriminatory classification test and the average benefits test. Betterment will always try to make the test pass using the ratio test method first. Permitted disparity—Employees are given a pro-rata base contribution on their entire compensation (up until the IRS limit). In addition, employees who earn more than the integration level, will receive an excess contribution on the amount over that limit. The integration level that provides the highest disparity allowed (5.7%) is the Social Security Taxable Wage Base (SSTWB). Plans that choose to lower the integration amount will receive a reduced disparity limit. Why is it good? It offers younger HCE’s who make more than the SSTWB a greater benefit. Age-weighted profit sharing plan—Employees are given profit sharing contributions based on their retirement age. That is, the older the employee, the higher the contribution. Why is it good? It can help with employee retention. How do I figure out our company’s profit sharing contribution? First, consider which type of profit sharing plan you’ll be using—pro-rata, new comparability, permitted disparity, or age-weighted. Next, take a look at your company’s profits, business outlook, and other financial factors. Keep in mind that: There is no set amount that you have to contribute You don’t need to make contributions Even though it’s called “profit sharing,” you don’t need to show profits on your books to make contributions The IRS notes that the “comp-to-comp” or pro-rata method is one of the most common ways to determine each participant’s allocation. Using this method, you calculate the sum of all of your employees’ compensation (the “total comp”). To determine the profit sharing allocation, divide the profit sharing pool by the total comp. You then multiply this percentage by each employee’s salary. Here’s an example of how it works: Your profit sharing pool is $15,000, and the combined compensation of your three eligible employees is $180,000. Therefore, each employee would receive a contribution equal to 8.3% of their salary. Employee Salary Calculation Profit sharing contribution Taylor $40,000 $15,000 x 8.3% $3,333 Robert $60,000 $15,000 x 8.3% $5,000 Lindsay $80,000 $15,000 x 8.3% $6,667 What are the key benefits of profit sharing for employers? It’s easy to see why profit sharing helps employees, but you may be wondering how it helps your small business. Consider these key benefits: Provide a valuable benefit (while controlling costs)—With employer matching contributions, your costs can dramatically rise if you onboard several new employees. However, with profit sharing, the amount you contribute is entirely up to you. Business is doing well? Contribute more to share the wealth. Business hits a rough spot? Contribute less (or even skip a year). Attract and retain top talent—Profit sharing is a generous perk when recruiting new employees. Plus, you can tweak your profit sharing rules to aid in retention. For example, some employers may elect to have a graded or cliff profit sharing contribution vesting schedule to motivate employees to continue working for their company. Rack up the tax deductions—Profit sharing contributions are tax deductible and not subject to payroll (e.g., FICA) taxes! So if you’re looking to lower your taxable income in a profitable year, your profit sharing plan can help you make the highest possible contribution (and get the highest possible tax write-off). Motivate employees to greater success—Employees who know they’ll receive financial rewards when their company does well are more likely to perform at a higher level. Companies may even link profit sharing to performance goals to motivate employees. What are the rules? The IRS clearly defines rules for contribution limits and calculation rules, tax deduction limits, deadlines, and disclosures (as with any type of 401(k) plan!). Be sure to keep an eye out for any annual changes from the IRS. Are there any downsides to offering a profit sharing plan? Contribution rate flexibility is one of the greatest benefits of a profit sharing 401(k) plan—but it could also be one of its greatest downsides. If business is down one year and employees get a lower profit sharing contribution than they expect, it could have a detrimental impact on morale. However, for many companies, the advantages of a profit sharing 401(k) plan outweigh this risk. How do I set up a profit sharing 401(k) plan? If you already have a 401(k) plan, it requires an amendment to your plan document. However, you’ll want to take the time to think through how your profit sharing plan supports your company’s goals. Betterment can help. At Betterment, we’re here to help with a range of tasks from nondiscrimination testing to plan design consulting to ensure your profit sharing 401(k) plan is working the way your business needs. And as a 3(38) fiduciary, we take full responsibility for selecting and monitoring your investments so you can focus on running your business—not managing your retirement plan. Ready for a better profit sharing 401(k) plan? Get started here. The information provided is education only and is not investment or tax advice. Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Betterment or its authors endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise. -

![]()

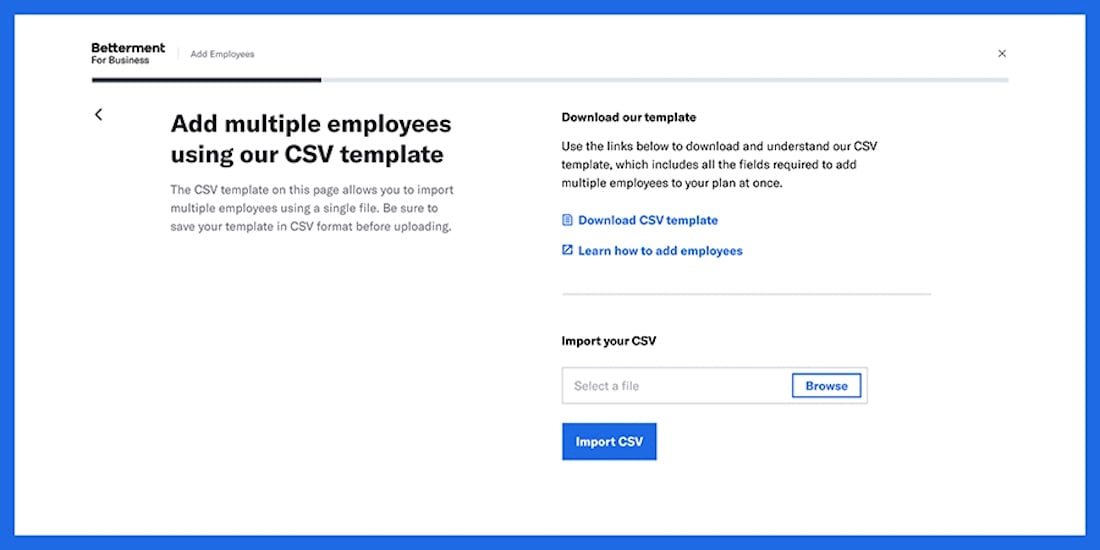

Betterment 401(k) – Bulk Upload Tutorial for Plan Sponsors

Betterment’s bulk upload tool allows you to add multiple employees to your plan quickly. ...

Betterment 401(k) – Bulk Upload Tutorial for Plan Sponsors Betterment’s bulk upload tool allows you to add multiple employees to your plan quickly. This tutorial outlines best practices and shares helpful tips for using our bulk upload tool effectively. Step-by-step Tutorial Log in to the employer dashboard Navigate to: employees → add employees → add multiple employees Download the CSV template Open the CSV template using a program like Microsoft Excel, Apple Numbers, or Google Sheets Fill out one row for each employee you want to upload. Use the table below to understand the columns in the template: Column Description First Name The employee’s legal first name No special characters accepted Last Name The employee’s legal last name No special characters accepted Middle Initial Leave blank if the employee doesn’t have a legal middle name Social Security Number The employee’s government-issued Social Security Number If the employee is not a US Citizen, a Social Security Number still needs to be provided Social Security Numbers should be formatted with hyphens, e.g.: 123-45-6789 Email Betterment uses email to complete the employee sign-up process and to send employees important plan notifications and updates Date of Birth Date should be formatted as MM/DD/YYYY Employment Status This field accepts the following inputs: active (currently employed) terminated (formerly employed) deceased (deceased) disabled (on disability leave) unpaid_leave (unpaid leave) retired (retired former employee) Date of Hire Date of hire can be up to one year in the future Date should be formatted as MM/DD/YYYY Date of Termination This field is required if Employment Status is terminated, deceased, disabled or retired This field can be left blank for employees who are active or who are on unpaid leave Date of termination can be up to one year in the future Date should be formatted as MM/DD/YYYY Date of Rehire This field is required if Employment Status is active and Date of Termination is set Address Line 1 This field is required for all employees The employee’s residential address cannot be a PO Box If the employee’s address includes a comma, you must put that address within quotation marks Address Line 2 This field can be left blank if the employee’s residential address is only one line City Part of the employee’s residential address State Part of the employee’s residential address State should be written using the official two-letter postal abbreviation Examples: NY, FL, CA, TX 5 Digit ZIP Code Part of the employee’s residential address Eligible This field accepts an input of Y or N If an employee will be hired in the future, you must enter N for Eligible, and enter a date in the Entry on column. This indicates that the employee will become eligible for the plan on the future date you’ve specified. Entry on This field defines the date on which an employee will become eligible for the 401(k) plan This date can be in the past or the future Date should be formatted as MM/DD/YYYY Electronic Access This field accepts an input of Y or N Can this employee receive emails and access Betterment’s website at a computer they use regularly as part of their job? Union Member This field accepts an input of Y or N Is this employee a member of a union? Date Joined Union Required if the employee is a member of a union Date should be formatted as MM/DD/YYYY Can be left blank for non-union employees Participant Type This field accepts the following inputs: primary (all participants who are currently in the plan, whether active, terminated, deceased, disabled, retired, or on leave) beneficiary (beneficiary of a deceased participant) alternate_payee (a person who will be the payee of a divorce or other legal settlement) Deferral Rate If an employee was participating in a 401(k) plan you had with a previous provider, please indicate their contribution rate from that provider. This will be used as their new default rate at Betterment. The employee will be able to log into their account to change this prior to their first contribution with Betterment. Traditional deferral amount and percent cannot both be present. Roth deferral amount and percent cannot both be present. If you’re not switching to Betterment from a previous provider, you can leave this field blank. After you’re done filling out the document, export the file as a CSV. Upload your CSV file to Betterment. If you receive any errors after uploading your file, review the errors and make changes to your CSV file. Re-upload the file to Betterment after making changes. Once your file is accepted without any errors, you’ll be asked to review the names of the newly created employees. This helps ensure that you’re uploading the correct file to your plan. When you’re done reviewing, click the ‘add employees’ button. Next, the upload process will begin. Once your employees have been uploaded, they’ll receive an email inviting them to complete the sign-up process. Finally, check the employees page to make sure there are no outstanding errors that occurred during the employee creation process. Address any errors that may have occurred. You’re all set! All new participant profiles will be visible on the employees page. You can return to the employees page to make changes to an employee’s profile at any time. Frequently Asked Questions Do I have to do anything else? Nope! You’re all set. Betterment will email all required disclosures to your new plan participants. Do I have to send any notices to my employees? No, Betterment will send all notices to your employees automatically via email. When will my employees be alerted? Employees will be notified by email as soon as their account is created. How can my employees join the plan after I upload their information to Betterment? Employees can check their email for an invite from Betterment to complete the sign-up process. My employee has a P.O. Box as their address. Can I use that address with Betterment? No. To comply with regulations for opening accounts, we require a physical address to verify an employee's identity. Betterment will not send physical mail to an employee’s address (unless they opt into paper statements, which is rare); we will otherwise only use their physical address for account verification. Questions? Contact us. -

![]()

Plan Design Matters

Thoughtful 401(k) plan design can help motivate even reluctant retirement savers to start ...