Getting Started

-

![]()

How to pick a 401(k) contribution rate

How to pick a 401(k) contribution rate Your 401(k) contribution rate - also known as a deferral rate or savings rate - is a key part of a successful retirement strategy. You’ve taken that first step and have set up your Betterment 401(k) account - well done! One important piece to consider next is your contribution rate - how much from each paycheck will go into your account? With your Betterment 401(k), you could use a percentage or a fixed dollar amount, whichever you prefer. Here are a few things to consider: Were you automatically enrolled? Many employers choose to automatically enroll their employees in the plan with a default contribution rate of 3% – if you're not sure, please check with your employer or take a look in your Retirement goal. Keep in mind, whatever the default contribution rate is, it’s just a starting point. You can (and probably should) increase that contribution rate at any time in your account. At least a decade without a paycheck Most experts recommend contributing 10%–15% of your paycheck to have enough to last you through retirement - which could be 20-30 years considering how long people are living! If you retire at age 65, with a healthy lifestyle and no major risk factors, you could live well into your 80s or 90s. That means you'll want to set yourself up for living off your personal savings and investments for about 20 years! Starting small is better than nothing If 10-15% of your paycheck sounds absurd to you right now - deep breath, think of that as something to aim for. You can start with something smaller, maybe 5 or 6%, and slowly but surely increase your savings rate every year – your birthday? Give yourself a gift and increase it by 1%. Your work anniversary? Cheers to you, bump it up again. And those 1% increases can actually be a big deal. Go for the max Because of its tax benefits, the IRS sets a limit on how much you can put into your 401(k) every year. So you could aim to contribute as much as the IRS allows! For people 50 and over, the limit is higher, which is referred to as “catch-up contributions.” And if you really want to be an over-achiever, you can also contribute to an IRA, an individual retirement account, to save even more. Tax considerations With your Betterment 401(k), you can make contributions into a traditional 401(k) account and/or a Roth 401(k). There are tax benefits to both: Traditional 401(k): Contributions are deducted from your paycheck before taxes are withheld, which can lower your taxable income. Both your contributions and investment earnings are “tax-deferred,” meaning you won’t pay taxes on what you contributed to the account as well as any earnings until you withdraw the money at retirement. In other words, save on taxes now, pay taxes later. Roth 401(k): Contributions are made with after-tax dollars so your withdrawals—both the contributions and earnings—are tax-free once you decide to retire (minimum age, 59½), and as long as you’ve held the Roth account for at least five years. In other words, pay taxes now, no taxes later. Remember that you can use both! Say you want to contribute 10% towards your retirement? You can put 5% into a traditional 401(k) and 5% into the Roth 401(k). This is one way you can balance your tax exposure. If you already have your account set up, log in today to adjust your contribution rate or reassess your traditional and Roth contributions. Haven’t started saving in your Betterment 401(k) yet? Check your email for an access link from Betterment, or get in touch: Send us an email: support@betterment.com Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET -

![]()

When’s the best time to invest for retirement? Now.

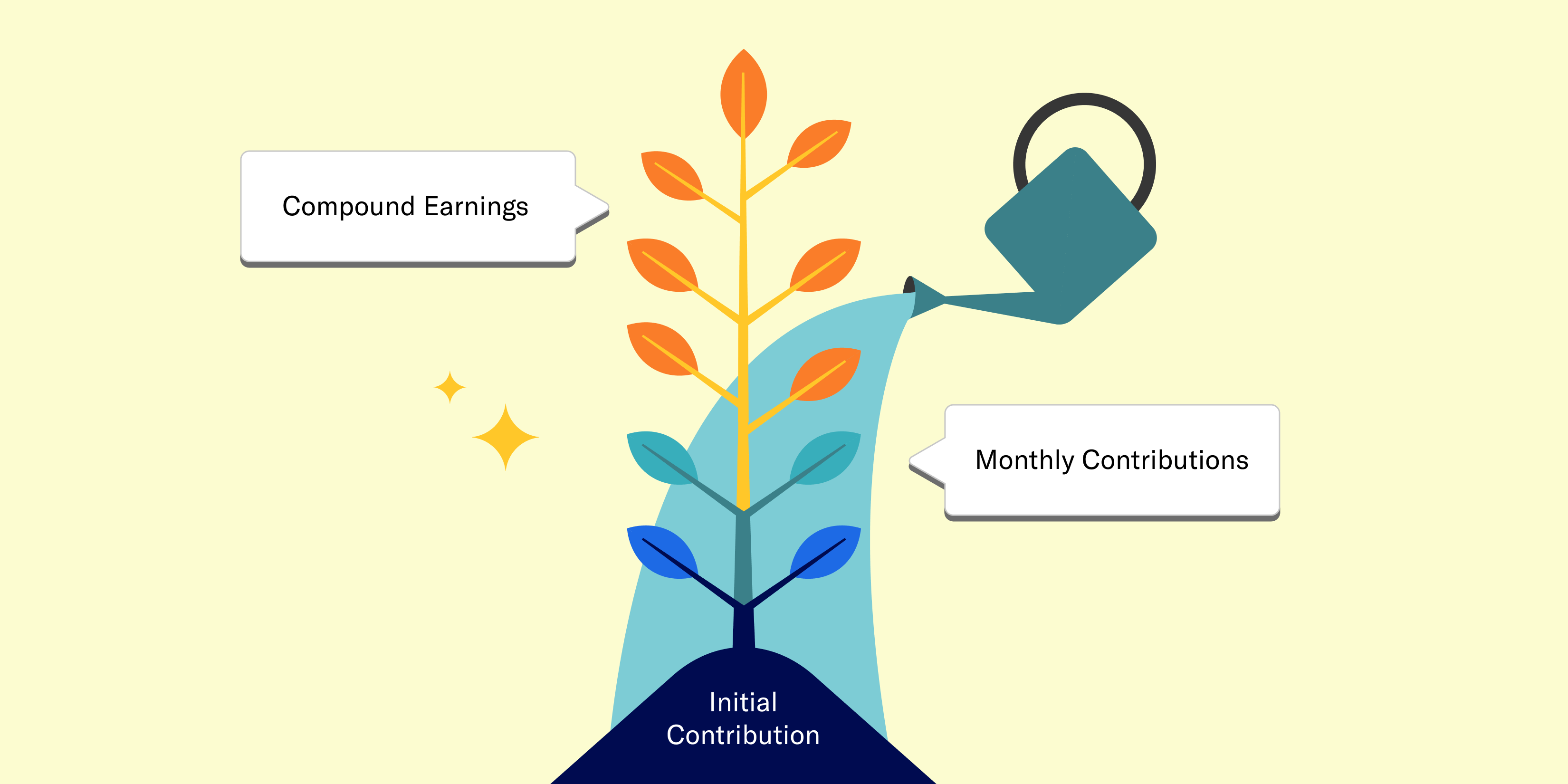

When’s the best time to invest for retirement? Now. Should you start saving for retirement? Unless you are on one of those richest-people-in-the-world lists - then the answer is, most likely, yes. From paying the rent or mortgage, credit card bills, student loans, daily living expenses - there are a lot of things competing for your money’s attention! The idea of saving for retirement can easily be pushed to the backburner for all of those other - completely understandable! - reasons. But we’re here to say - hold the phone. Even a little bit into a 401(k) can make a huge difference for your retirement. Rock and roll When a rock rolls down a hill, it goes faster and faster on its way down. It has something to do with momentum and physics – we’re not scientists here, we’re investment professionals. But the same concept applies to your 401(k) - not because of physics, but because of compounding interest. Compounding interest means that not only are your original dollars growing based on potential stock market gains, but that newly earned money also grows whenever the stock market goes up! See how it works with this calculator tool. Give compounding time to shine If the magic of compounding interest isn’t enough to get you going right away, there is one other factor to consider. If someone starts saving 6% of their paycheck at age 25, they are expected to end up with more money at age 65 than someone who contributes 10% starting at age 40. And here’s the real kicker - the person who’s doing 10% starting at age 40 will put in more of their own dollars, and is still expected to end up with less by the time they reach age 65. How is that possible? The 6% contributions had more time to grow – more time to roll down that hill gathering speed – or in this case – money. If you already have an account, log in today to view your contribution rate and consider giving it a bump – even a 1% increase can make a difference in your retirement years! Haven’t started saving in your Betterment 401(k) yet? Check your email for an access link from Betterment, or get in touch: Send us an email: support@betterment.com Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET -

![]()

Your Betterment 401(k) - One Amazing Benefit

Your Betterment 401(k) - One Amazing Benefit Your employer chose Betterment as its 401(k) provider - so come on in and be invested for your future. Traveling around the world. Taking up a new hobby. Spending more time with family and friends. Whatever your retirement dreams are, a 401(k) can help you make them a reality. And luckily for you, your employer chose Betterment to manage its 401(k) plan. Top 3 perks of a 401(k) Participating in your employer’s 401(k) plan is a good idea for many reasons – here are the top three. With a 401(k), you can: Contribute via convenient, automatic payroll deductions (one less thing to think about!). Save on taxes, whether those savings happen today with a traditional 401(k) or at retirement with a Roth 401(k) (and the cool thing is that you can use both!). Invest more than with other retirement vehicles (individual retirement accounts (IRAs) have lower caps on how much you can put in). All said, saving for retirement with a 401(k) is basically a no-brainer. Without a regular paycheck in retirement, you’re going to rely on your own savings. And we’re not talking about cash-under-the-mattress savings or even safe-in-the-bank savings - but invested savings, which is what you get with a 401(k). (Why is it so critical to invest for long-term goals, rather than simply saving money in the bank? To tackle one word: Inflation.) Top Betterment features Betterment offers several features to help you pursue your retirement goals: Goal based – Your 401(k) will automatically be a “Retirement” goal on the Betterment platform (you could add additional goals for other things if you want). Our goal-based platform looks at your timeline until retirement and the desired amount you want to save, to help you invest in an expert-built portfolio. Low cost – Our approach uses low-cost exchange-traded funds (ETFs) so more of your money stays invested in your account. High tech –Certain portfolio strategies and goal types are automatically rebalanced and adjusted over time, and our tax-smart tools are available to you at no added management fee. Personalized – Betterment helps you work towards your long- and short-term financial goals with personalized advice. It’s easy to get started Betterment will contact you via email to set up your account via a secure link that’s unique to you. If you haven’t received an invitation from us to set up your account, please contact us. Once you’ve set up your account, be sure to set a contribution rate to help you pursue your goals (although starting with anything is far better than nothing!) and you’ll want to initiate a rollover of any old 401(k)s into your new Betterment 401(k). Were you automatically enrolled in your plan? If so, you still need to set up your account with a username and password. If your employer has determined an automatic contribution rate for your organization, know that you can adjust this in your account at any time. Betterment strives to make saving and investing for retirement easy. But we know you still might have questions, so we’re here to help: Explore our 401(k) employee resources Send us an email: support@betterment.com Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET -

![]()

Rolling over is more than a dog trick

Rolling over is more than a dog trick Three reasons why rolling over 401(k)s from former employers may make sense. Have money sitting in 401(k) accounts from former employers? If so, you’re not alone. Recent research estimates that there are more than 24 million “forgotten” 401(k) accounts, holding approximately $1.35 trillion dollars. Are any of those dollars yours? If so, you should consider rolling any old 401(k) into your new Betterment 401(k) – here’s why: 1. Get a comprehensive view of your retirement savings When you have accounts here, there and anywhere, it’s hard to get a handle on where you stand. By rolling them over to your Betterment account and consolidating your retirement assets in one place, you can ensure your portfolio is appropriately diversified, monitor your progress, and rest assured that your investments aren’t competing or canceling each other out. 2. Avoid fees! Every 401(k) plan comes with fees. If you have multiple 401(k)s, you are paying fees for all of those accounts! Betterment has fees too –but we use low-cost exchange-traded funds (ETFs) in our portfolios, helping to keep fees low. 3. Access personalized financial advice and service Whether you want to talk investment strategy or review your retirement account, Betterment has CERTIFIED FINANCIAL PLANNER™ professionals and a customer support team that’s easy to reach when you need them. Your plan may include complimentary access to our team of CFPs® or you can book a call for a one-time fee. Other options Since you have access to a Betterment 401(k) through your employer, it could make sense for you to roll old 401(k)s into your Betterment 401(k) for all the reasons outlined above. But you do have other options: Leave it where it is. Roll it into an IRA (Individual Retirement Account), either with Betterment or another financial institution. Cash it out – this will come with taxes and potentially fees, and your money will no longer be invested (and potentially growing) for your retirement. Ready to roll? In just a few clicks, you can start the rollover process to Betterment and be set up with an appropriate investment strategy for you. You’ll receive a personalized set of rollover instructions via email, with no paperwork required by us. Have a different kind of account to roll over? No problem. You can roll over your IRAs, pensions, 401(a)s, 457(b)s, profit sharing plans, stock plans, and Thrift Savings Plans (TSPs) to Betterment using the same simple process. If you've already claimed your account, you can click here to start your rollover. If you have any questions along the way, our team is ready to help: Send us an email: support@betterment.com Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET