Why Rebalancing Is Necessary

Over time, the value of individual ETFs in a diversified portfolio moves up and down, drifting away from their target weights. For example, over the long term, stocks generally rise faster than bonds. The stock portion of your portfolio may go up in value faster relative to the bond portion–if you don’t rebalance.

The difference between the target weights for your portfolio and the actual weights in your current portfolio is called drift.

Rebalancing is what corrects drift, bringing your portfolio back to its target allocation.

Measuring and defining "Drift"

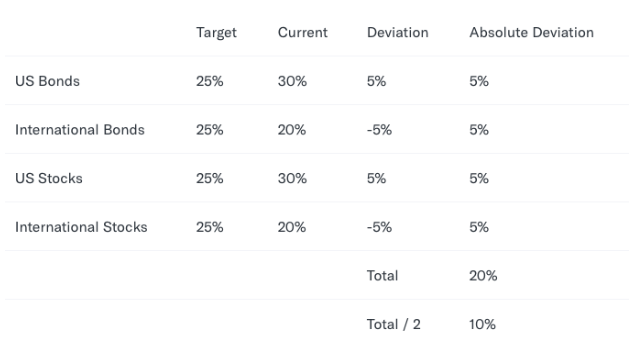

We define portfolio drift as the total absolute deviation of each asset class from its target, divided by two. Here’s a simplified example, with only four assets:

A high drift reduces the efficiency of your portfolio and may expose you to more (or less) risk than you intended when you set the target allocation.

Taking actions to reduce this drift is called rebalancing, which Betterment automatically does for you in several ways—depending on the circumstances—and with an eye on tax efficiency. Our methods for rebalancing are:

- Cash Flow Rebalancing: suggested when drift reaches 2%

- Sell/Buy Rebalancing: automatically triggered when drift reaches 3%*

- Allocation Change Rebalancing: corrects drift when you manually change your target allocation

*Note that Dimensional Fund Advisor portfolios used by our Betterment For Advisors platform has an alternate sell/buy rebalancing drift threshold of 5%, and the drift is calculated based on fund-level drift rather than asset-class drift.

See here for details on each of these rebalancing methods.

Related Articles