Nick Holeman, CFP®

Meet our writer

Nick Holeman, CFP®

Director of Financial Planning, Betterment

Nick enjoys teaching others how to make sense of their complicated financial lives. Nick earned his graduate degree in Financial and Tax Planning and has since helped countless individuals and families achieve their goals.

Articles by Nick Holeman, CFP®

-

![]()

How To Plan For Retirement

It depends on the lifestyle you want, the investment accounts available, and the income ...

How To Plan For Retirement It depends on the lifestyle you want, the investment accounts available, and the income you expect to receive. Most people want to retire some day. But retirement planning looks a little different for everyone. There’s more than one way to get there. And some people want to live more extravagantly—or frugally—than others. Your retirement plan should be based on the life you want to live and the financial options you have available. And the sooner you sort out the details, the better. Even if retirement seems far away, working out the details now will set you up to retire when and how you want to. In this guide, we’ll cover: How much you should save for retirement Choosing retirement accounts Supplemental income to consider Self-employed retirement options How much should you save for retirement? How much you need to save ultimately depends on what you want retirement to look like. Some people see themselves traveling the world when they retire. Or living closer to their families. Maybe there’s a hobby you’ve wished you could spend more time and money on. Perhaps for you, retirement looks like the life you have now—just without the job. For many people, that’s a good place to start. Take the amount you spend right now and ask yourself: do you want to spend more or less than that each year of retirement? How long do you want your money to last? Answering these questions will give you a target amount you’ll need to reach and help you think about managing your income in retirement. Don’t forget to think about where you’ll want to live, too. Cost of living varies widely, and it has a big effect on how long your money will last. Move somewhere with a lower cost of living, and you need less to retire. Want to live it up in New York City, Seattle, or San Francisco? Plan to save significantly more. And finally: when do you want to retire? This will give you a target date to save it by (in investing, that’s called a time horizon). It’ll also inform how much you need to retire. Retiring early reduces your time horizon, and increases the number of expected years you need to save for. Choosing retirement accounts Once you know how much you need to save, it’s time to think about where that money will go. Earning interest and taking advantage of tax benefits can help you reach your goal faster, and that’s why choosing the right investment accounts is a key part of retirement planning. While there are many kinds of investment accounts in general, people usually use five main types to save for retirement: Traditional 401(k) Roth 401(k) Traditional IRA (Individual Retirement Account) Roth IRA (Individual Retirement Account) Traditional 401(k) A Traditional 401(k) is an employer-sponsored retirement plan. These have two valuable advantages: Your employer may match a percentage of your contributions Your contributions are tax deductible You can only invest in a 401(k) if your employer offers one. If they do, and they match a percentage of your contributions, this is almost always an account you’ll want to take advantage of. The contribution match is free money. You don’t want to leave that on the table. And since your contributions are tax deductible, you’ll pay less income tax while you’re saving for retirement. Roth 401(k) A Roth 401(k) works just like a Traditional one, but with one key difference: the tax advantages come later. You make contributions, your employer (sometimes) matches a percentage of them, and you pay taxes like normal. But when you withdraw your funds during retirement, you don’t pay taxes. This means any interest you earned on your account is tax-free. With both Roth and Traditional 401(k)s, you can contribute a maximum of $20,500 in 2022, or $27,000 if you’re age 50 or over. Traditional IRA (Individual Retirement Account) As with a 401(k), an IRA gives you tax advantages. Depending on your income, contributions may lower your pre-tax income, so you pay less income tax leading up to retirement. The biggest difference? Your employer doesn’t match your contributions. The annual contribution limits are also significantly lower: just $6,000 for 2022, or $7,000 if you’re age 50 or over. Roth IRA (Individual Retirement Account) A Roth IRA works similarly, but as with a Roth 401(k), the tax benefits come when you retire. Your contributions still count toward your taxable income right now, but when you withdraw in retirement, all your interest is tax-free. So, should you use a Roth or Traditional account? One option is to use both Traditional and Roth accounts for tax diversification during retirement. Another strategy is to compare your current tax bracket to your expected tax bracket during retirement, and try to optimize around that. Also keep in mind that your income may fluctuate throughout your career. So you may choose to do Roth now, but after a significant promotion you might switch to Traditional. Health Savings Account (HSA) An HSA is another solid choice. Contributions to an HSA are tax deductible, and if you use the funds on medical expenses, your distributions are tax-free. After age 65, you can withdraw your funds just like a traditional 401(k) or IRA, even for non-medical expenses. You can only contribute to a Health Savings Accounts if you’re enrolled in a high-deductible health plan (HDHP). In 2022, you can contribute up to $3,650 to an HSA if your HDHP covers only you, and up to $7,300 if your HDHP covers your family. What other income can you expect? Put enough into a retirement account, and your distributions will likely cover your expenses during retirement. But if you can count on other sources of income, you may not need to save as much. For many people, a common source of income during retirement is social security. As long as you or your spouse have made enough social security contributions throughout your career, you should receive social security benefits. Retire a little early, and you’ll still get some benefits (but it may be less). This can amount to thousands of dollars per month. You can estimate the benefits you’ll receive using the Social Security Administration’s Retirement Estimator. Retirement accounts for the self-employed Self-employed people have a few additional options to consider. One Participant 401(k) Plan or Solo 401(k) A Solo 401(k) is similar to a regular 401(k). However, with a Solo 401(k), you’re both the employer and the employee. You can combine the employee contribution limit and the employer contribution limit. As long as you don’t have any employees and you’re your own company, this is a pretty solid option. However, a Solo 401(k) typically requires more advance planning and ongoing paperwork than other account types. If your circumstances change, you may be able to roll over your Solo 401(k) plan or consolidate your IRAs into a more appropriate retirement savings account. Simplified Employee Pension (SEP IRA) With a SEP IRA, the business sets up an IRA for each employee. Only the employer can contribute, and the contribution rate must be the same for each qualifying employee. Savings Incentive Match Plan for Employees (SIMPLE IRA) A SIMPLE IRA is ideal for small business owners who have 100 employees or less. Both the employer and the employee can contribute. You can also contribute to a Traditional IRA or Roth IRA—although how much you can contribute depends on how much you’ve put into other retirement accounts. -

![]()

What To Do With An Inheritance Or Major Windfall

You may feel the urge to splurge, but don’t waste this opportunity to move closer to your ...

What To Do With An Inheritance Or Major Windfall You may feel the urge to splurge, but don’t waste this opportunity to move closer to your financial goals. It’s hard to be rational when thousands of dollars appear in your bank account, or you’re staring at a massive check. You might be excitedly thinking about what to buy with a tax refund. Or mourning the loss of a loved one who left you an inheritance. Whether you were expecting this windfall or not, it’s important to slow down and think about the best way to use it. Many people might let their impulses get the better of them. But used wisely, every windfall is a chance to give your financial plan a boost. In this guide, we’ll cover: Why it’s so easy to waste a windfall Why taxes should always come first What to do with the rest of your windfall Why it’s so easy to waste a windfall We tend to treat windfalls like inheritances differently than we treat other money. Many of us naturally think of it like a “bonus,” so saving may not even cross our mind. And even if you’ve worked hard to develop healthy spending habits, a sudden windfall can undo your effort. Here’s how it might happen: An inheritance makes your cash balance spike. You spend a little on early splurges, and start to slack on saving habits. This behavior snowballs, and a few months or years later, you face two consequences: you’ve completely spent the inheritance, and you’ve lost the good fiscal habits you had before. You may also fall into the trap of overextending your finances after using an inheritance for a big purchase. Say you use the inheritance for a down payment on a bigger house. Along with a bigger house comes higher property taxes, home maintenance costs, homeowner’s insurance, and monthly utilities. New furniture, too. Your monthly expenses can expand quickly while your income stays the same. The moment you find yourself with a lot of extra money, you should also think about taxes. Why taxes should always come first You don’t want to spend money you don’t have. If you burn through your windfall without setting aside money for taxes, that’s exactly what you could be doing. You’re not going to pay taxes on a tax refund, but if you receive an inheritance, win the lottery, sell a property, or find yourself in another unique situation, you could owe some hefty taxes. The best thing to do is consult a certified public accountant (CPA) or tax advisor to determine if you owe taxes on your windfall. What to do with the rest of your windfall Once taxes are taken care of, look at your windfall as an opportunity to accelerate your financial goals. Remember, if you created a financial plan, you already thought about the purchases and milestones that will be most meaningful to you. Sure, plans can change, but many of your responsibilities and long-term goals will stay the same. Still stuck? Here are some high-impact financial goals you can make serious progress on in the event of a windfall. Pay down your debt Left unchecked, high-interest debt can often outpace your financial gains. Credit card debt is especially dangerous. And while your student loan debt may have low interest rates, paying it off early could save you thousands of dollars. Paying off debt doesn’t have to mean you can’t work toward other financial goals—the important thing is to consider how fast your debt will accrue interest, and make paying it off one of your top priorities. Depending on the size of your windfall, you could snap your fingers and make your debt disappear. Boost your retirement fund It’s not always fun to plan years into the future, but putting some of your windfall to work in your retirement fund could make life a lot easier down the road. Put enough into retirement savings, and you may even be able to adjust your retirement plan. Maybe you could think about retiring earlier, or giving yourself more money to spend each year of retirement. Refinance your mortgage Paying off your primary mortgage isn’t usually a top priority, but refinancing can be a smart move. If you’re paying mortgage insurance and your equity has gone up enough, refinancing might mean you can stop. And locking in a lower interest rate can save tens of thousands of dollars over the life of your mortgage. Taking this step means your goal of home ownership may interfere less with your other financial goals. Revisit your safety net Any time your cost of living or responsibilities change, your emergency fund needs to keep up. Whatever stage of life you’re in, you want to be confident you have the finances to stay afloat in a crisis. If you suddenly lost your job or couldn’t work, do you have enough set aside to maintain your current lifestyle for at least a few months? Start estate planning Wherever you’re at in life, it’s important to consider what would happen if you suddenly died or became incapacitated. What would happen to you, your loved ones, and your assets? Would your finances make it into the right hands? Would they be used in the right ways? When you find yourself with a major windfall, it’s a good time to create or reevaluate your estate plan. Take time to double-check that you’ve set beneficiaries for all of your investment accounts. If you haven’t already, create a will and appoint a power of attorney. If you have children, you may want to set up a trust. Estate planning isn’t fun, but it can start paying immediate dividends in the form of peace of mind. -

![]()

What Is A Fiduciary, And Do I Need One for My Investments?

When it comes to getting help managing your financial life, transparency is the name of ...

What Is A Fiduciary, And Do I Need One for My Investments? When it comes to getting help managing your financial life, transparency is the name of the game. When you seek out financial advice, it’s reasonable to assume your advisor would put your best interests ahead of their own. But the truth is, if the investment advisor isn’t a fiduciary, they aren’t actually required to do so. So in this guide, we’ll: Define what exactly a fiduciary is and how they differ from other financial advisors Consider when it can be important to work with a fiduciary Learn how to be a proactive investment shopper What is a fiduciary, and what is the fiduciary duty? A fiduciary is a professional or institution that has the power to act on behalf of another party, and is required to do what is in the best interest of the other party to preserve good faith and trust. An investment advisor with a fiduciary duty to its clients is obligated to follow both a duty of care and a duty of loyalty to their clients. The duty of care requires a fiduciary to act in the client’s best interest. Under the duty of loyalty, the fiduciary must also attempt to eliminate or disclose all potential conflicts of interest. Not all advisors are held to the same standards when providing advice, so it’s important to know who is required to act as a fiduciary. Financial advisors not acting as fiduciaries operate under a looser guideline called the suitability standard. Advisors who operate under a suitability standard have to choose investments that are appropriate based on the client’s circumstances, but they neither have to put the clients’ best interests first nor disclose or avoid conflicts of interest so long as the transaction is considered suitable. What are examples of conflicts of interest? When in doubt, just follow the money. How do your financial advisors get paid? Are they incentivised to take actions that might not be in your best interest? Commissions are one of the most common conflicts of interest. At large brokerages, it’s still not uncommon for investment professionals to primarily rely on commissions to make money. With commission-based pay, your advisor might receive a cut each time you trade, plus a percentage each time they steer your money into certain investment companies’ financial products. They can be motivated to recommend you invest in funds that pay them high commissions (and cost you a higher fee), even if there’s a comparable and cheaper fund that benefits your financial strategy as a client. When is it important to work with a fiduciary? When looking for an advisor to trade on your behalf and make investment decisions for you, you should strongly consider choosing a fiduciary advisor. This should help ensure that you receive suitable recommendations that will also be in your best interest. If you want to entrust an advisor with your financials and give them discretion, you may want to make sure they’re legally required to put your interests ahead of their own. On the other hand, if you’re simply seeking help trading securities in your portfolio, or you don’t want to give an advisor discretion over your accounts, you may not need a fiduciary advisor. How to be a proactive investment shopper Hiring a fiduciary advisor to manage your portfolio is one of the best ways to try and ensure you are receiving unbiased advice. We highly recommend verifying that your professional is getting paid to meet your needs, not the needs of a broker, fund, or external portfolio strategy. Ask the tough questions: “I’d love to learn how you’re paid in this arrangement. How do you make money?” “How do you protect your clients from your own biases? Can you tell me about potential conflicts of interest in this arrangement?” “What’s the philosophy behind the advice you give? What are the aspects of investment management that you focus on most?” “What would you say is your point of differentiation from other advisors?” Some of these questions may be answered in a Form CRS, which is a relationship summary that advisors and brokers are required to give their clients or customers as of summer 2020. You should also know the costs of your current investments and compare them with other options in the marketplace as time goes on. If alternatives seem more attractive, ask your advisor why they haven’t suggested making a switch. And if the explanation you get seems inadequate, consider whether you should continue working with your investment professional. Why is Betterment a fiduciary? A common point of confusion is whether or not robo-advisors can be fiduciaries. So let’s clear up any ambiguities: Yes, they certainly can be. Betterment is a Registered Investment Advisor (RIA) with the SEC and is held to the fiduciary standard as required under the Investment Advisers Act. Acting as a fiduciary aligns with Betterment’s mission because we are committed to helping you build a better life, where you can save more for the future and can make the most of your money through our cash management products and our investing and retirement products. I, as well as the rest of Betterment’s dedicated team of human advisors, are also Certified Financial Planners® (CFP®, for short). We’re held to the fiduciary standard, too. This way, you can be sure that the financial advice you receive from Betterment, whether online or from our team of human advisors, is in your best interest. -

![]()

Financing An Education: A Guide For Students And Parents

There’s more than one way to finance your education. Learn more about two common ways: ...

Financing An Education: A Guide For Students And Parents There’s more than one way to finance your education. Learn more about two common ways: 529 plans and student loans. Whether you’re looking at university or trade school, education is expensive. And if you’re like most people, you probably don’t have that kind of cash on hand. Some manage to work their way through college, but depending on the school, even a full-time job will barely put a dent in your expenses. So how should you pay for school? The answer depends on how much time you have, where you live, and where you want to go. If you have money to set aside for school, a 529 plan might be your best bet. Student loans are always an option, too—you just have to be careful. In this guide, we’ll cover: Investing in a 529 plan Financing responsibly with student loans What’s a 529 plan and how do you choose one? A 529 plan is a specialized investment account with tax benefits. It works similarly to a Roth IRA or Roth 401(k). You put money into the account and pay taxes up front, and if you withdraw for education expenses, you usually don’t have to pay taxes on anything you earned. While IRAs and 401(k)s help you plan for retirement, 529 plans help you plan for education expenses. Oh, and every state has its own plan. There are two types of 529 plans: Prepaid tuition plans With a prepaid tuition plan, you pay for tuition credits upfront, using today’s tuition rates. Fewer and fewer states offer these plans, but since tuition costs are always increasing, they can be a good option. Who knows how much tuition will cost in the coming years! The downside is that this money can only be used for tuition, and there are plenty of other education expenses. Education savings plans An education savings plan is more like a traditional investment account. You invest in funds, stocks, bonds, and other financial assets, and your account has the potential to grow through compound interest. You can also use this money on more than just tuition. Depending on your state, you could use your account for education fees, living expenses, technology, school supplies, or even student loan payments. Use it on anything else, and there’s a 10% penalty. 529 plan limitations Every 529 plan needs a specific beneficiary. It could be yourself, your child, a grandkid, a friend—whoever. Their age doesn’t matter. The only limitations are what the funds can be used for and how much you can contribute. Everything you put into a 529 plan is considered “a gift” to the beneficiary. And there are limits to how much you can gift to a person each year before being subject to gift tax rules. But you also have a lifetime limit in the millions of dollars. After that, there’s a gift tax. Gift tax rules are complex, so we recommend consulting a tax professional. Every state is different 529 plans can vary widely from state-to-state. And since you can choose plans from other states, it’s worth shopping around. While some plans let you apply your account to in-state or out-of-state education, others don’t. If you’re looking at a plan you can only use in-state, make sure you’re comfortable with the available schools. Some states offer a match program, where they’ll match a percentage of 529 plan contributions from low- and middle-income families. This could substantially boost your savings. Your state might also offer a full or partial tax break on your contributions—but that usually only applies if you live in state. And of course, each 529 plan is an investment account, so you’ll also want to review the investment choices and consider the cost of fees. For every plan, the account’s total worth can only be equal to the “expected amount” of future education expenses for each beneficiary. But that’s going to vary widely from state to state. The exact limit depends on which 529 plan you choose, but it’s typically a few hundred thousand dollars for each beneficiary. If you’re wanting to save for a private college or grad program, that may not be enough. And if your state’s limit is lower than what you think you’ll need, that may offset the benefit of a state tax break or match program. And according to Federal law, you can use up to $10,000 from a 529 plan to pay for “enrollment or attendance at an eligible elementary or secondary school.” It also lets you apply $10,000 toward student loans. But some states don’t follow these federal laws. If they don’t, and you use your funds like this anyway, you’ll have to pay a 10% penalty. Bottom line: Do your research, and make sure you’re familiar with the specifics of your 529 plan. How to choose a 529 plan The best 529 plan for you depends on: Where you live Where you or your beneficiary will go to school How much you want to save What you want to spend this money on But if you’re wondering how to tell which plan is likely to make the most of your money, it really comes down to just three things: tax benefits, fees, and investment choices. Be sure to look at all plan details and compare these factors before choosing one. Student loan basics Student loans have a bad reputation. And it’s understandable. About 43 million Americans owe an average of $39 thousand in student loans. The average student needs to borrow about $30,000 to earn their bachelor’s degree. But when it comes down to it, if you don’t have money to contribute to a 529 plan or investment account (or your account doesn’t have enough money), your options are: Work your way through college Take out student loans Even with a job, you may need to take student loans. Used wisely (and sparingly), student loans don’t have to consume your finances or derail your other goals. But as with 529 plans, you can’t assume every loan is the same. Types of student loans There are two main types of student loans to consider: Federal Private Federal student loans often (but not always) have the lowest interest rates, don’t require credit checks, and come with benefits like pathways to loan forgiveness. You don’t need a cosigner to get most federal loans, and nearly all students with a highschool diploma or GED are eligible for them. However, there’s a cap on how much money you can take out in federal loans, and some types of federal loans require you to demonstrate financial need. Financial institutions like banks can also provide private student loans. These typically require a good credit score, and you can take out as much as you need (as long as you’re approved for it). Another big difference: with private loans, you typically start making payments immediately and have a fixed repayment schedule set by your lender. With federal loans, you may not have to pay while you’re in school, you get a six-month grace period after you graduate, and you can choose from four repayment plans. Federal loan repayment options Federal loans give you flexibility with repayment. If you’re struggling to make monthly payments, you can choose one of four Income-Driven Repayment (IDR) plans that may work better for your situation. Each of these plans allows for payments based on your income, usually 10-20% of it with a few exceptions, which makes individual payments more manageable. Unfortunately, this usually also means you’ll be making payments for longer. Check out the Federal Student Loan website for more detailed information on each plan. If you want to pay off your loans faster, you can also select a Graduated Repayment Plan, which increases your payments periodically, ensuring you pay off your loans in 10 years. There’s also another way to ditch your federal loan payments ahead of schedule: loan forgiveness. Student loan forgiveness With federal loans, there are two pathways to loan forgiveness: Public service Income-Driven Repayment Go into the right line of work after college, and you could be eligible for Public Student Loan Forgiveness (PSLF). This is available to students who pursue careers with nonprofits, government agencies, and some public sectors. If you make monthly qualifying payments for 10 years, then you can apply for forgiveness. If you don’t qualify for PSLF, but you’re on an IDR plan, you have another potential pathway to forgiveness. After 20-25 years of monthly payments, you may qualify for forgiveness, too. Unfortunately, on this path, you have to pay income taxes on the amount that was forgiven. (This is referred to as a “tax bomb.”) Consolidating and refinancing student loans Sometimes it’s tough to juggle multiple repayment schedules, interest rates, and payment amounts. If you’re having a hard time keeping track of your student loans, you may want to consider consolidating them so you have one monthly payment. Consolidating through a private institution could also give you a new interest rate (the average of your old ones, or sometimes lower, depending on your circumstances) and let you adjust your payment time horizon. The federal consolidation program won’t change your interest rate, but it will still group your loans into a single payment for you. Whatever loans you wind up with and whatever your repayment plan, make sure you stay on top of your minimum payments. Fees and penalties can significantly increase your debt over time. -

![]()

How To Use Your Health Savings Account (HSA) For Retirement

Once you turn 65, you can use them for anything you want—without incurring penalties.

How To Use Your Health Savings Account (HSA) For Retirement Once you turn 65, you can use them for anything you want—without incurring penalties. Health Savings Accounts (HSAs) are designed to cover future medical expenses. But that’s not the only way to use them. Thanks to their tax benefits and withdrawal rules, HSAs can make a valuable addition to your retirement plan. In this guide, we’ll cover: HSA eligibility The benefits of HSAs HSA contribution limits HSA withdrawal rules Using an HSA for retirement Am I eligible for an HSA? To be eligible for an HSA, you have to: Be covered under a high deductible health plan (HDHP). Not be enrolled in Medicare. Not be claimed as a dependent on someone else’s tax return. Have no other health coverage except what the IRS covers under “Other Employee Health Plans.” Your employer may have information on HSA providers available to you. The expanded IRS rules can provide more detailed eligibility information. What are the benefits of an HSA? Health Savings Accounts have a couple tax benefits that help you make the most of your assets. Your contributions are pre-tax, meaning you can deduct them from your income taxes. You can use these funds at any time to pay for qualified medical expenses without paying taxes or penalties. And when you turn 65, you can use your HSA for anything without incurring a penalty. While you must have a high deductible health plan in order to contribute to your HSA, your HSA isn’t tied to a specific employer. It stays with you when you change jobs or retire. The money doesn’t leave the account until you use it. Also, your employer may contribute to your HSA—and since the contribution is pre-tax, it doesn’t count toward your gross income. Some HSAs are specialized savings accounts. But some are actually investment accounts. Any interest and earnings that come from these HSAs are tax-free provided you don’t use them on unqualified expenses before you turn 65. So HSAs can rank amongst the best ways to save for retirement, on par with some 401(k)s and IRAs depending on factors such as an employer match, fees, and/or investment choices. HSA contribution limits In 2022, the HSA contribution limit for self-only HDHP coverage is $3,650, while the limit for family HDHP coverage is $7,300. HSA withdrawal rules Need some money to cover unexpected medical costs? Make a tax-free withdrawal. Don’t need it? Save it for your retirement. Withdrawing from an HSA for non-medical expenses comes with a 20% penalty . . . unless you’re over 65. Once you turn 65, withdrawals from an HSA work a lot like withdrawals from a traditional IRA or 401(k). Your withdrawals count toward your annual income, so you’ll pay income taxes based on your tax bracket. However, if you use your withdrawal to pay for medical expenses, it’s still tax-free. Basically, there are three possible outcomes when you withdraw from an HSA—and it all comes down to your age and what you use the money for. Your age Qualified Medical Expenses Other Expenses Less than 65 years old No taxes, no penalty Taxes are applicable, 20% penalty 65 years old or older Taxes are applicable, no penalty How to use your Health Savings Account for retirement When you reach retirement age, medical bills can start to add up quickly. Use your HSA to cover these expenses, and you’re triple-dipping on the tax benefits! Your contributions are tax free, your interest and earnings are tax free, and so are your withdrawals. From a financial planning perspective, that’s hard to beat. And it can make expenses like long-term care a lot less frightening. But an HSA is also a great supplement to your IRA or 401(k). Since the 20% penalty disappears when you turn 65, you won’t have to worry about whether an expense is qualified—just use your money as you see fit. Considerations before you choose an HSA An HSA is like a financial Swiss Army Knife. But while it’s highly versatile, it’s not the right choice for everyone. So, before you switch health plans and open an HSA, there are a few things to consider. Know the fees When it comes to fees and other costs, HSAs are often less transparent than accounts like 401(k)s. Look at the full fee schedule for your HSA before contributing. Also, sometimes your employer will cover all, or a portion, of your fees—so find out about that, too. Explore the investment options Ideally, you want an HSA with investment options that fit your goals. Some providers only allow investments with low risk and low returns, like money market funds. Other HSAs offer multiple mutual fund listings with higher returns and more risk exposure. Some HSAs have minimums before you can start investing. For example, you might only be able to invest your money once you’ve contributed $1,000 to the HSA. Stay current on withdrawal rules Withdrawal rules around taxes and penalties can change with new regulations, so it’s important to stay up-to-date with any new changes that take place. Don’t just switch to an HDHP A high-deductible health plan isn’t right for everyone. Before switching to an HDHP so you can use an HSA to save for retirement, make sure that works for you and your family. A high-deductible health plan brings with it the potential for higher out-of-pocket medical costs. -

![]()

Investing in Your 20s: 4 Major Financial Questions Answered

When you're in your 20s, you may be starting to invest or you might have some existing ...

Investing in Your 20s: 4 Major Financial Questions Answered When you're in your 20s, you may be starting to invest or you might have some existing assets you need to take better care of. Pay attention to these major issues. For most of us, our 20s is the first decade of life where investing might become a priority. You may have just graduated college, and having landed your first few full-time jobs, you’re starting to get serious about putting your money to work. More likely than not, you’re motivated and eager to start forging your financial future. Unfortunately, eagerness alone isn’t enough to be a successful investor. Once you make the decision to start investing, and you’ve done a bit of research, dozens of new questions emerge. Questions like, “Should I invest or pay down debt?” or “What should I do to start a nest egg?” In this article, we’ll cover the top four questions we hear from investors in their twenties that we believe are important questions to be asking—and answering. “Should I invest aggressively just because I’m young?” “Should I pay down my debts or start investing?” “Should I contribute to a Roth or Traditional retirement account?” “How long should it take to see results?” Let’s explore these to help you develop a clearer path through your 20s. “Should I invest aggressively just because I’m young?” Young investors often hear that they should invest aggressively because they “have time on their side.” That usually means investing in a high percentage of stocks and a small percentage of bonds or cash. While the logic is sound, it’s really only half of the story. And the half that is missing is the most important part: the foundation of your finances. The portion of your money that is for long-term goals, such as retirement, should most likely be invested aggressively. But in your twenties you have other financial goals besides just retirement. Let’s look at some common goals that should not have aggressive, high risk investments just because you’re young. A safety net. It’s extremely important to build up an emergency fund that covers 3-6 months of your expenses. We usually recommend your safety net should be kept in a lower risk option, like a high yield savings account or low risk investment account. Wedding costs. According to the U.S. Census Bureau, the median age of a first marriage for men is 29, and for women, it’s 27. You don’t want to have to delay matrimony just because the stock market took a dip, so money set aside for these goals should also probably be invested conservatively. A home down payment. The median age for purchasing a first home is age 33, according to the the National Association of Realtors. That means most people should start saving for that house in their twenties. When saving for a relatively short-term goal—especially one as important as your first home—it likely doesn’t make sense to invest very aggressively. So how should you invest for these shorter-term goals? If you plan on keeping your savings in cash, make sure your money is working for you. Consider using a cash account like Cash Reserve, which could earn a higher rate than traditional savings accounts. If you want to invest your money, you should separate your savings into different buckets for each goal, and invest each bucket according to its time horizon. An example looks like this. The above graph is Betterment’s recommendation for how stock-to-bond allocations should change over time for a major purchase goal. And don’t forget to adjust your risk as your goal gets closer—or if you use Betterment, we’ll adjust your risk automatically with the exception of our BlackRock Target Income portfolio. “Should I pay down my debts or start investing?” The right risk level for your investments depends not just on your age, but on the purpose of that particular bucket of money. But should you even be investing in the first place? Or, would it be better to focus on paying down debt? In some cases, paying down debt should be prioritized over investing, but that’s not always the case. Here’s one example: “Should I pay down a 4.5% mortgage or contribute to my 401(k) to get a 100% employer match?” Mathematically, the employer match is usually the right move. The return on a 100% employer match is usually better than saving 4.5% by paying extra on your mortgage if you’re planning to pay the same amount for either option. It comes down to what is the most optimal use of your next dollar. We've discussed the topic in more detail previously, but the quick summary is that, when deciding to pay off debt or invest, use this prioritized framework: Always make your minimum debt payments on time. Maximise the match in your employer-sponsored retirement plan. Pay off high-cost debt. Build your safety net. Save for retirement. Save for your other goals (home purchase, kid’s college). “Should I contribute to a Roth or Traditional retirement account?” Speaking of employer matches in your retirement account, which type of retirement account is best for you? Should you choose a Roth retirement account (e.g. Roth 401(k), Roth IRA) in your twenties? Or should you use a traditional account? As a quick refresher, here’s how Roth and traditional retirement accounts generally work: Traditional: Contributions to these accounts are usually pre-tax. In exchange for this upfront tax break, you usually must pay taxes on all future withdrawals. Roth: Contributions to these accounts are generally after-tax. Instead of getting a tax break today, all of the future earnings and qualified withdrawals will be tax-free. So you can’t avoid paying taxes, but at least you can choose when you pay them. Either now when you make the contribution, or in the future when you make the withdrawal. As a general rule: If your current tax bracket is higher than your expected tax bracket in retirement, you should choose the Traditional option. If your current tax bracket is the same or lower than your expected tax bracket in retirement, you should choose the Roth option. The good news is that Betterment’s retirement planning tool can do this all for you and recommend which is likely best for your situation. We estimate your current and future tax bracket, and even factor in additional factors like employer matches, fees and even your spouse’s accounts, if applicable. “How long should it take to see investing results?” Humans are wired to seek immediate gratification. We want to see results and we want them fast. The investments we choose are no different. We want to see our money grow, even double or triple as fast as possible! We are always taught of the magic of compound interest, and how if you save $x amount over time, you’ll have so much money by the time you retire. That is great for initial motivation, but it’s important to understand that most of that growth happens later in life. In fact very little growth occurs while you are just starting. The graph below shows what happens over 30 years if you save $250/month in today’s dollars and earn a 7% rate of return. By the end you’ll have over $372,000! But it’s not until year 5 that you would earn more money than you contributed that year. And it would take 18 years for the total earnings in your account to be larger than your total contributions. How Compounding Works: Contributions vs. Future Earnings The figure shows a hypothetical example of compounding, based on a $3,000 annual contribution over 30 years with an assumed growth rate of 7%, compounded each year. Performance is provided for illustrative purposes, and performance is not attributable to any actual Betterment portfolio nor does it reflect any specific Betterment performance. As such, it is not net of any management fees. Content is meant for educational purposes on the power of compound interest over time, and not intended to be taken as advice or a recommendation for any specific investment product or strategy. The point is it can take time to see the fruits of your investing labor. That’s entirely normal. But don’t let that discourage you. Some things you can do early on to help are to make your saving automatic and reduce your fees. Both of these things will help you save more and make your money work harder. Use Your 20s To Your Advantage Your 20s are an important time in your financial life. It is the decade where you can build a strong foundation for decades to come. Whether that’s choosing the proper risk level for your goals, deciding to pay down debt or invest, or selecting the right retirement accounts. Making the right decisions now can save you the headache of having to correct these things later. Lastly, remember to stay the course. It can take time to see the type of growth you want in your account. -

![]()

The Benefits of Estimating Your Tax Bracket When Investing

Knowing your tax bracket opens up a huge number of planning opportunities that have the ...

The Benefits of Estimating Your Tax Bracket When Investing Knowing your tax bracket opens up a huge number of planning opportunities that have the potential to save you taxes and increase your investment returns. If you’re an investor, knowing your tax bracket opens up a number of planning opportunities that can decrease your tax liability and increase your investment returns. Investing based on your tax bracket is something that good CPAs and financial advisors, including Betterment, do for customers. Because the IRS taxes different components of investment income (e.g., dividends, capital gains, retirement withdrawals) in different ways depending on your tax bracket, knowing your tax bracket is an important part of optimizing your investment strategy. In this article, we’ll show you how to estimate your tax bracket and begin making more strategic decisions about your investments with regards to your income taxes. First, what is a tax bracket? In the United States, federal income tax follows what policy experts call a "progressive" tax system. This means that people with higher incomes are generally subject to a higher tax rate than people with lower incomes. 2022 Tax Brackets Tax rate Taxable income for single filers Taxable income for married, filing jointly 10% $0 to $10,275 $0 to $20,550 12% $10,276 to $41,775 $20,551 to $83,550 22% $41,776 to $89,075 $83,551 to $178,150 24% $89,076 to $170,050 $178,151 to $340,100 32% $170,051 to $215,950 $340,101 to $431,900 35% $215,951 to $539,900 $431,901 to $647,850 37% $539,901 or more $647,851 or more Source: Internal Revenue Service Instead of thinking solely in terms of which single tax bracket you fall into, however, it's helpful to think of the multiple tax brackets each of your dollars of taxable income may fall into. That's because tax brackets apply to those specific portions of your income. For example, let's simplify things and say there's hypothetically only two tax brackets for single filers: A tax rate of 10% for taxable income up to $10,000 A tax rate of 20% for taxable income of $10,001 and up If you're a single filer and have taxable income of $15,000 this year, you fall into the second tax bracket. This is what's typically referred to as your "marginal" tax rate. Portions of your income, however, fall into both tax brackets, and those portions are taxed accordingly. The first $10,000 of your income is taxed at 10%, and the remaining $5,000 is taxed at 20%. How difficult is it to estimate my tax bracket? Luckily, estimating your tax bracket is much easier than actually calculating your exact taxes, because U.S. tax brackets are fairly wide, often spanning tens of thousands of dollars. That’s a big margin of error for making an estimate. The wide tax brackets allow you to estimate your tax bracket fairly accurately even at the start of the year, before you know how big your bonus will be, or how much you will donate to charity. Of course, the more detailed you are in calculating your tax bracket, the more accurate your estimate will be. And if you are near the cutoff between one bracket and the next, you will want to be as precise as possible. How Do I Estimate My Tax Bracket? Estimating your tax bracket requires two main pieces of information: Your estimated annual income Tax deductions you expect to file These are the same pieces of information you or your accountant deals with every year when you file your taxes. Normally, if your personal situation has not changed very much from last year, the easiest way to estimate your tax bracket is to look at your last year’s tax return. The 2017 Tax Cuts and Jobs Act changed a lot of the rules and brackets. The brackets may also be adjusted each year to account for inflation. Thus, it might make sense for most people to estimate their bracket by crunching new numbers. Estimating Your Tax Bracket with Last Year’s Tax Return If you expect your situation to be roughly similar to last year, then open up last year’s tax return. If you review Form 1040, you can see your taxable income on Page 1, Line 15, titled “Taxable Income.” As long as you don’t have any major changes in your income or personal situation this year, you can use that number as an estimate to find the appropriate tax bracket. Estimating Your Tax Bracket by Predicting Income, Deductions, and Exemptions Estimating your bracket requires a bit more work if your personal situation has changed from last year. For example, if you got married, changed jobs, had a child or bought a house, those, and many more factors, can all affect your tax bracket. It’s important to point out that your taxable income, the number you need to estimate your tax bracket, is not the same as your gross income. The IRS generally allows you to reduce your gross income through various deductions, before arriving at your taxable income. When Betterment calculates your estimated tax bracket, we use the two factors above to arrive at your estimated taxable income. You can use the same process. Add up your income from all expected sources for the year. This includes salaries, bonuses, interest, business income, pensions, dividends and more. If you’re married and filing jointly, don’t forget to include your spouse’s income sources. Subtract your deductions. Tax deductions reduce your taxable income. Common examples include mortgage interest, property taxes and charity, but you can find a full list on Schedule A – Itemized Deductions. If you don’t know your deductions, or don’t expect to have very many, simply subtract the Standard Deduction instead. By default, Betterment assumes you take the standard deduction. If you know your actual deductions will be significantly higher than the standard deduction, you should not use this assumption when estimating your bracket, and our default estimation will likely be inaccurate. The number you arrive at after reducing your gross income by deductions and exemptions is called your taxable income. This is an estimate of the number that would go on line 15 of your 1040, and the number that determines your tax bracket. Look up this number on the appropriate tax bracket table and see where you land. Again, this is only an estimate. There are countless other factors that can affect your marginal tax bracket such as exclusions, phaseouts and the alternative minimum tax. But for planning purposes, this estimation is more than sufficient for most investors. If you have reason to think you need a more detailed calculation to help formulate your financial plan for the year, you can consult with a tax professional. How Can I Use My Tax Bracket to Optimize My Investment Options? Now that you have an estimate of your tax bracket, you can use that information in many aspects of your financial plan. Here are a few ways that Betterment uses a tax bracket estimate to give you better, more personalized advice. Tax-Loss Harvesting: This is a powerful strategy that seeks to use the ups/downs of your investments to save you taxes. However, it typically doesn't make sense if you fall into a lower tax bracket due to the way capital gains are taxed differently. Tax Coordination: This strategy reshuffles which investments you hold in which accounts to try to boost your after-tax returns. For the same reasons listed above, if you fall on the lower end of the tax bracket spectrum, the benefits of this strategy are reduced significantly. Traditional vs. Roth Contributions: Choosing the proper retirement account to contribute to can also save you taxes both now and throughout your lifetime. Generally, if you expect to be in a higher tax bracket in the future, Roth accounts are best. If you expect to be in a lower tax bracket in the future, Traditional accounts are best. That’s why our automated retirement planning advice estimates your current tax bracket and where we expect you to be in the future, and uses that information to recommend which retirement accounts make the most sense for you. In addition to these strategies, Betterment’s team of financial experts can help you with even more complex strategies such as Roth conversions, estimating taxes from moving outside investments to Betterment and structuring tax-efficient withdrawals during retirement. Tax optimization is a critical part to your overall financial success, and knowing your tax bracket is a fundamental step toward optimizing your investment decisions. That’s why Betterment uses estimates of your bracket to recommend strategies tailored specifically to you. It’s just one way we partner with you to help maximize your money. -

![]()

Buying A Home: Down Payments, Mortgages, And Saving For Your Future

Your home may be the largest single purchase you make during your lifetime. That can make ...

Buying A Home: Down Payments, Mortgages, And Saving For Your Future Your home may be the largest single purchase you make during your lifetime. That can make it both incredibly exciting and nerve wracking. Purchasing a primary residence often falls in the gray area between a pure investment (meant to increase one’s capital) and a consumer good (meant to increase one’s satisfaction). Your home has aspects of both, and we recognize that you may purchase a home for reasons that are not strictly monetary, such as being in a particular school district or proximity to one’s family. Those are perfectly valid inputs to your purchasing decision. However, this guide will focus primarily on the financial aspects of your potential home purchase: We’ll do this by walking through the five tasks that should be done before you purchase your home: Build your emergency fund Choose a fixed-rate mortgage Save for a down payment and closing costs Think long-term Calculate your monthly affordability Build your emergency fund Houses are built on top of foundations to help keep them stable. Just like houses, your finances also need a stable foundation. Part of that includes your emergency fund. We recommend that, before purchasing a home, you should have a fully-funded emergency fund. Your emergency fund should be a minimum of three months’ worth of expenses. How big your emergency fund should be is a common question. By definition, emergencies are difficult to plan for. We don’t know when they will occur or how much they will cost. But we do know that life doesn’t always go smoothly, and thus that we should plan ahead for unexpected emergencies. Emergency funds are important for everyone, but especially so if you are a homeowner. When you are a renter, your landlord is likely responsible for the majority of repairs and maintenance of your building. As a homeowner, that responsibility now falls on your shoulders. Yes, owning a home can be a good investment, but it can also be an expensive endeavor. That is exactly why you should not purchase a home before having a fully-funded emergency fund. And don’t forget that your monthly expenses may increase once you purchase your new home. To determine the appropriate size for your emergency fund, we recommend using what your monthly expenses will be after you own your new home, not just what they are today. Choose a fixed-rate mortgage If you’re financing a home purchase by way of a mortgage, you have to choose which type of mortgage is appropriate for you. One of the key factors is deciding between an adjustable-rate mortgage (ARM) and a fixed-rate mortgage (FRM). Betterment generally recommends choosing a fixed-rate mortgage, because while ARMs usually—but not always—offer a lower initial interest rate than FRMs, this lower rate comes with additional risk. With an ARM, your monthly payment can increase over time, and it’s difficult to predict what those payments will be. This may make it tough to stick to a budget and plan for your other financial goals. Fixed-rate mortgages, on the other hand, lock in the interest rate for the lifetime of the loan. This stability makes budgeting and planning for your financial future much easier. Locking in an interest rate for the duration of your mortgage helps you budget and minimizes risk. Most home buyers do choose a fixed-rate mortgage. According to 2021 survey data by the National Association of Realtors®, 92% of home buyers who financed their home purchase used a fixed-rate mortgage, and this was very consistent across all age groups. Research by the Urban Institute also shows FRMs have accounted for the vast majority of mortgages over the past 2 decades. Save for a down payment and closing costs You’ll need more than just your emergency fund to purchase your dream home. You’ll also need a down payment and money for closing costs. Betterment recommends making a down payment of at least 20%, and setting aside about 2% of the home purchase for closing costs. It’s true that you’re often allowed to purchase a home with down payments far below 20%. For example: FHA loans allow down payments as small as 3.5%. Fannie Mae allows mortgages with down payments as small as 3%. VA loans allow you to purchase a home with no down payment. However, Betterment typically advises putting down at least 20% when purchasing your home. A down payment of 20% or more can help avoid Private Mortgage Insurance (PMI). Putting at least 20% down is also a good sign you are not overleveraging yourself with debt. Lastly, a down payment of at least 20% may help lower your interest rate. This is acknowledged by the CFPB and seems to be true when comparing interest rates of mortgages with Loan-to-Values (LTVs) below and above 80%, as shown below. Source: Federal Reserve Bank of St. Louis. Visualization of data by Betterment. Depending on your situation, it may even make sense to go above a 20% down payment. Just remember, you likely should not put every spare dollar you have into your home, as that could mean you don’t have enough liquid assets elsewhere for things such as your emergency fund and other financial goals like retirement. Closing Costs In addition to a down payment, buying a home also has significant transaction costs. These transaction costs are commonly referred to as “closing costs” or “settlement costs.” Closing costs depend on many factors, such as where you live and the price of the home. ClosingCorp, a company that specializes in closing costs and services, conducted a study that analyzed 2.9 million home purchases throughout 2020. They found that closing costs for buyers averaged 1.69% of the home’s purchase price, and ranged between states from a low of 0.71% of the home price (Missouri) up to a high of 5.90% of the home price (Delaware). The chart below shows more detail. Source: ClosingCorp, 2020 Closing Cost Trends. Visualization of data by Betterment. As a starting point, we recommend saving up about 2% of the home price (about the national average) for closing costs. But of course, if your state tends to be much higher or lower than that, you should plan accordingly. In total, that means that you should generally save at least 20% of the home price to go towards a down payment, and around 2% for estimated closing costs. With Betterment, you can open a Major Purchase goal and save for your downpayment and closing costs using either a cash portfolio or investing portfolio, depending on your risk tolerance and when you think you’ll buy your home. Think long-term We mentioned the closing costs for buyers above, but remember: There are also closing costs when you sell your home. These closing costs mean it may take you a while to break even on your purchase, and that selling your home soon after is more likely to result in a financial loss. That’s why Betterment doesn’t recommend buying a home unless you plan to own that home for at least 4 years, and ideally longer. Unfortunately, closing costs for selling your home tend to be even higher than when you buy a home. Zillow, Bankrate, NerdWallet, The Balance and Opendoor all estimate them at around 8% to 10% of the home price. The below chart is built from 2020 survey data by the National Association of Realtors® and shows that most home sellers stay in their homes beyond this 4 year rule of thumb. Across all age groups, the median length of time was 10 years. That’s excellent. However, we can see that younger buyers, on average, come in well below the 10-year median, which indicates they are more at risk of not breaking even on their home purchases. Source: National Association of Realtors®, 2020 Home Buyers and Sellers Generational Trends. Visualization of data by Betterment. Some things you can do to help ensure you stay in your home long enough to at least break even include: If you’re buying a home in an area you don’t know very well, consider renting in the neighborhood first to make sure you actually enjoy living there. Think ahead and make sure the home makes sense for you four years from now, not just you today. Are you planning on having kids soon? Might your elderly parents move in with you? How stable is your job? All of these are good questions to consider. Don’t rush your home purchase. Take your time and think through this very large decision. The phrase “measure twice, cut once” is very applicable to home purchases. Calculate your monthly affordability The upfront costs are just one component of home affordability. The other is the ongoing monthly costs. Betterment recommends building a financial plan to determine how much home you can afford while still achieving your other financial goals. But if you don’t have a financial plan, we recommend not exceeding a debt-to-income (DTI) ratio of 36%. In other words, you take your monthly debt payments (including your housing costs), and divide them by your gross monthly income. Lenders often use this as one factor when it comes to approving you for a mortgage. Debt income ratios There are lots of rules in terms of what counts as income and what counts as debt. These rules are all outlined in parts of Fannie Mae’s Selling Guide and Freddie Mac’s Seller/Servicer Guide. While the above formula is just an estimate, it is helpful for planning purposes. In certain cases Fannie Mae and Freddie Mac will allow debt-to-income ratios as high as 45%-50%. But just because you can get approved for that, doesn’t mean it makes financial sense to do so. Keep in mind that the lender’s concern is your ability to repay the money they lent you. They are far less concerned with whether or not you can also afford to retire or send your kids to college. The debt to income ratio calculation also doesn’t factor in income taxes or home repairs, both of which can be significant. This is all to say that using DTI ratios to calculate home affordability may be an okay starting point, but they fail to capture many key inputs for calculating how much you personally can afford. We outline our preferred alternative below, but if you do choose to use a DTI ratio, we recommend using a maximum of 36%. That means all of your debts—including your housing payment—should not exceed 36% of your gross income. In our opinion, the best way to determine how much home you can afford is to build a financial plan. That way, you can identify your various financial goals, and calculate how much you need to be saving on a regular basis to achieve those goals. With the confidence that your other goals are on-track, any excess cash flow can be used towards monthly housing costs. Think of this as starting with your financial goals, and then backing into home affordability, instead of the other way around. Wrapping things up If owning a home is important to you, the five steps in this guide can help you make a wiser purchasing decision: Have an emergency fund of at least three months’ worth of expenses to help with unexpected maintenance and emergencies. Choose a fixed-rate mortgage to help keep your budget stable. Save for a minimum 20% down payment to avoid PMI, and plan for paying ~2% in closing costs. Don’t buy a home unless you plan to own it for at least 4 years. Otherwise, you are not likely to break even after you factor in the various costs of homeownership. Build a financial plan to determine your monthly affordability, but as a starting point, don’t exceed a debt-to-income ratio of 36%. -

![]()

Take on More Control with Flexible Portfolios

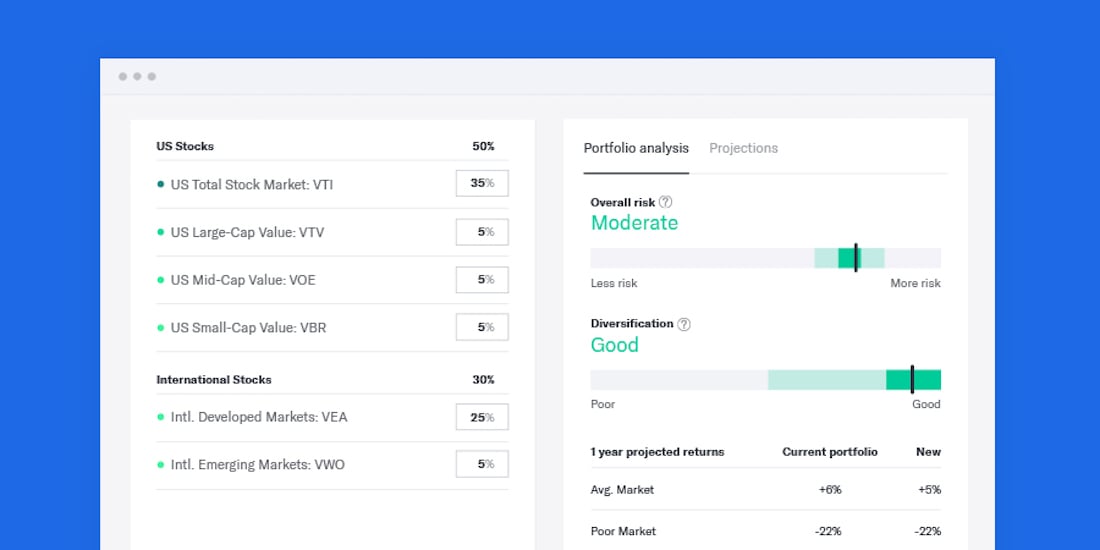

For experienced investors looking to tweak asset class weights, we offer a Flexible ...

Take on More Control with Flexible Portfolios For experienced investors looking to tweak asset class weights, we offer a Flexible portfolio option. Let’s say you’re an experienced investor. You’re already a Betterment customer—or you’re considering becoming one. You dig our personalized approach to automated investing, but you’d like to get granular with your portfolio’s specific asset class weights. Well, our Flexible portfolio option lets you do just that. It starts with our Core portfolio’s distribution of asset classes before handing over the wheel to you, so to speak. In the process, you get access to additional asset classes including Commodities, High Yield Bonds, and REITs. If all of this sounds a little overwhelming or confusing, you should probably consider sticking with one of our expert-built, curated portfolio options. But for those comfortable with the added risk, research, and responsibility in general that comes with managing your own portfolio, a Flexible portfolio may be a good fit. Keep reading for more details on the pros, cons and other considerations of this option. The benefits of a Flexible portfolio You get a sound start with the Betterment portfolio strategy Our investing advice has several layers, and the portfolio we recommend to you is just one of them. At the core is our approach to building a diversified, risk-efficient portfolio strategy and our cost-aware selection of ETFs. A Flexible portfolio lets you benefit from this approach and start with the asset class weighting we believe comprises a diversified portfolio, but gives you the final say in those weights. You get principled feedback on your Flexible portfolio You can tweak the asset class weights, but we’ll still rate the diversification and relative risk of those tweaks before any investment changes are actually made. We want any customer with a Flexible portfolio to better understand the risks of the changes they’re considering. This also lets you experiment with different weights in theory before putting them into practice. For illustrative purposes only You can still benefit from our automation and tax optimization Although the use of a Flexible portfolio means your preferences may deviate from our portfolio recommendation, you still get access to our automated investing and tax features. These include things like automatic rebalancing and Tax Loss Harvesting+. Altering or removing asset classes altogether, however, may impact the effectiveness of tax-saving strategies. The drawbacks of a Flexible portfolio Adjusting an investment portfolio requires careful consideration, experience, and a higher level of effort beyond choosing one of our preset portfolio strategies. Your performance may be better or worse than the performance of those portfolio strategies with a comparable level of risk. And beyond the potential for diminished tax-saving strategies, choosing a Flexible portfolio also disables the Auto-adjust feature. This feature automatically “glides” your portfolio to a lower overall risk level as you get closer to the end date of your goal. Without it, you’ll be responsible for manually maintaining the appropriate allocation of stocks and/or bonds and its corresponding risk level. -

![]()

How to Get Started Investing in Crypto

Investing in crypto is complicated but it doesn’t have to be. Here’s how to get started.

How to Get Started Investing in Crypto Investing in crypto is complicated but it doesn’t have to be. Here’s how to get started. Think about investing in stocks and bonds. Most people are not experts, yet most are comfortable enough to invest. That’s our goal with crypto: helping you feel comfortable enough to decide if it’s right for you. Before you invest in crypto, our team of financial advisors recommends having a solid financial plan in place. This includes things like paying off high-interest debt, starting an emergency fund, and saving for retirement. Once you have that foundation, we’re here to walk you through the world of Crypto Investing. Three steps to get started investing in crypto. Step 1: Learn about the major cryptocurrencies and categories. You don’t have to be an expert but the goal is to be comfortable with concepts like the metaverse and decentralized finance. The largest cryptocurrencies: Bitcoin - The first and largest cryptocurrency. It's a virtual currency designed to act as a form of payment outside the control of the traditional legacy financial system. Ethereum - A decentralized computing network best known for its virtual cryptocurrency, Ether or ETH. One of Ethereum’s distinguishing features is its smart contracts, a program that runs on the network and completes transactions without needing an intermediary. The big crypto categories: Metaverse - A growing number of platforms creating a decentralized network of virtual experiences, combining property, gaming, entertainment, social events, education, and more. Learn more about the metaverse. Decentralized Finance - Platforms offer financial services without the need for banks or other centralized institutions using smart contracts. Learn more about decentralized finance. Step 2: Decide how much you want to invest and for how long. We view investing in crypto as part of a diversified investment strategy, with a small crypto investment belonging alongside stocks, bonds, and other assets. Crypto Tip: Our golden rule - We recommend investing 5% or less of your total investable assets in crypto. Step 3: Pick your investment. We make that simple—you can pick a crypto portfolio based on your investment interests. Universe Portfolio Sustainable Portfolio Metaverse Portfolio Decentralized Finance Portfolio -

![]()

Top 5 Benefits of Managed Crypto Investing

Crypto investing is complex. We’re trying to make it simpler.

Top 5 Benefits of Managed Crypto Investing Crypto investing is complex. We’re trying to make it simpler. Our goal is to be here for you, to be your guide on your crypto investing journey. That’s why we created managed crypto portfolios, expertly-curated selections of crypto investments—so you don’t have to navigate the world of crypto alone. Check out the five benefits that we built our managed crypto portfolios around: 1. Diversification With our portfolios, you directly own multiple cryptocurrencies in a diversified way that reflects the crypto landscape. Investing in a diverse set of cryptocurrencies helps lower exposure to any single crypto asset, which may decrease the impact of volatility on your portfolio. 2. Automation You can turn on recurring deposits to invest effortlessly. Plus, automatic rebalancing helps manage risk in your portfolio. The automated rebalancing process is designed to periodically sell some of the highest-performing assets and buy some of the lowest-performing assets to return the basket to its overall desired weighting, reducing overexposure to any single crypto asset. 3. Expert-built Our experts track the industry closely to build and manage crypto portfolios designed to capture the long-term growth of crypto markets overall while mitigating risk through diversification. Our investment team curates portfolios using a set of consistent criteria for each crypto asset including an established historical trading history, an adequate market capitalization, and the ability to trade each individual crypto asset easily. 4. In-depth resources We’re here to help you better understand crypto, with short articles, videos, and our easy-to-read newsletter BetterBlocks. Check out our Crypto Resource Center. 5. Advanced security protocols You can invest comfortably knowing that we use advanced security protocols. We partnered with Gemini Trust Company, LLC as our custodian for crypto assets, and Gemini is a New York registered trust company regulated by the New York State Department of Financial Services (NYDFS) and New York Banking Law. -

![]()

How To Manage Your Income In Retirement

An income strategy during retirement can help make your portfolio last longer, while also ...

How To Manage Your Income In Retirement An income strategy during retirement can help make your portfolio last longer, while also easing potential tax burdens. Retirement planning doesn’t end when you retire. To have the retirement you’ve been dreaming of, you need to ensure your savings will last. And how much you withdraw each month isn’t all that matters. In this guide we’ll cover: Why changes in the market affect you differently in retirement How to help keep bad timing from ruining your retirement How to decide which accounts to withdraw from first How Betterment helps take the guesswork out of your retirement income Part of retirement planning involves thinking about your retirement budget. But whether you’re already retired or you’re simply thinking ahead, it’s also important to think about how you’ll manage your income in retirement. Retirement is a huge milestone. And reaching it changes how you have to think about taxes, your investments, and your income. For starters, changes in the market can seriously affect how long your money lasts. Why changes in the market affect you differently in retirement Stock markets can swing up or down at any time. They’re volatile. When you’re saving for a distant retirement, you usually don’t have to worry as much about temporary dips. But during retirement, market volatility can have a dramatic effect on your savings. An investment account is a collection of individual assets. When you make a withdrawal from your retirement account, you’re selling off assets to equal the amount you want to withdraw. So say the market is going through a temporary dip. Since you’re retired, you have to continue making withdrawals in order to maintain your income. During the dip, your investment assets may have less value, so you have to sell more of them to equal the same amount of money. When the market goes back up, you have fewer assets that benefit from the rebound. The opposite is true, too. When the market is up, you don’t have to sell as many of your assets to maintain your income. There will always be good years and bad years in the market. How your withdrawals line up with the market’s volatility is called the “sequence of returns.” Unfortunately, you can’t control it. In many ways, it’s the luck of the withdrawal. Still, there are ways to help decrease the potential impact of a bad sequence of returns. How to keep bad timing from ruining your retirement The last thing you want is to retire and then lose your savings to market volatility. So you’ll want to take some steps to try and protect your retirement from a bad sequence of returns. Adjust your level of risk As you near or enter retirement, it’s likely time to start cranking down your stock-to-bond allocation. Invest too heavily in stocks, and your retirement savings could tank right when you need them. Betterment generally recommends turning down your ratio to about 56% stocks in early retirement, then gradually decreasing to about 30% toward the end of retirement. Rebalance your portfolio During retirement, the two most common cash flows in/out of your investment accounts will likely be dividends you earn and withdrawals you make. If you’re strategic, you can use these cash flows as opportunities to rebalance your portfolio. For example, if stocks are down at the moment, you likely want to withdraw from your bonds instead. This can help prevent you from selling stocks at a loss. Alternatively, if stocks are rallying, you may want to reinvest your dividends into bonds (instead of cashing them out) in order to bring your portfolio back into balance with your preferred ratio of stocks to bonds. Keep a safety net Even in retirement, it’s important to have an emergency fund. If you keep a separate account in your portfolio with enough money to cover three to six months of expenses, you can likely cushion—or ride out altogether—the blow of a bad sequence of returns. Supplement your income Hopefully, you’ll have enough retirement savings to produce a steady income from withdrawals. But it’s nice to have other income sources, too, to minimize your reliance on investment withdrawals in the first place. Social Security might be enough—although a pandemic or other disaster can deplete these funds faster than expected. Maybe you have a pension you can withdraw from, too. Or a part-time job. Or rental properties. Along with the other precautions above, these additional income sources can help counter bad returns early in retirement. While you can’t control your sequence of returns, you can control the order you withdraw from your accounts. And that’s important, too. How to decide which accounts to withdraw from first In retirement, taxes are usually one of your biggest expenses. They’re right up there with healthcare costs. When it comes to your retirement savings, there are three “tax pools” your accounts can fall under: Taxable accounts: individual accounts, joint accounts, and trusts. Tax-deferred accounts: individual retirement accounts (IRAs), 401(k)s, 403(b)s, and Thrift Savings Plans Tax-free accounts: Roth IRAs, Roth 401(k)s Each of these account types (taxable, tax-deferred, and tax-free) are taxed differently—and that’s important to understand when you start making withdrawals. When you have funds in all three tax pools, this is known as “tax diversification.” This strategy can create some unique opportunities for managing your retirement income. For example, when you withdraw from your taxable accounts, you only pay taxes on the capital gains, not the full amount you withdraw. With a tax-deferred account like a Traditional 401(k), you usually pay taxes on the full amount you withdraw, so with each withdrawal, taxes take more away from your portfolio’s future earning potential. Since you don’t have to pay taxes on withdrawals from your tax-free accounts, it’s typically best to save these for last. You want as much tax-free money as possible, right? So, while we’re not a tax advisor, and none of this information should be considered advice for your specific situation, the ideal withdrawal order generally-speaking is: Taxable accounts Tax-deferred accounts Tax-free accounts But there are a few exceptions. Incorporating minimum distributions Once you reach a certain age, you must generally begin taking required minimum distributions (RMDs) from your tax-deferred accounts. Failure to do so results in a steep penalty on the amount you were supposed to take. This changes things—but only slightly. At this point, you may want to consider following a new order: Withdraw your RMDs. If you still need more, then pull from taxable accounts. When there’s nothing left in those, start withdrawing from your tax-deferred accounts. Pull money from tax-free accounts. Smoothing out bumps in your tax bracket In retirement, you’ll likely have multiple sources of non-investment income, coming from Social Security, defined benefit pensions, rental income, part-time work, and/or RMDs. Since these income streams vary from year to year, your tax bracket may fluctuate throughout retirement. With a little extra planning, you can sometimes use these fluctuations to your advantage. For years where you’re in a lower bracket than usual–say, if you’re retiring before you plan on claiming Social Security benefits–it may make sense to fill these low brackets with withdrawals from tax-deferred accounts before touching your taxable accounts, and possibly consider Roth conversions. For years where you’re in a higher tax bracket, like if you sell a home and end up with large capital gains–it may make sense to pull from tax-free accounts first to minimize the effect of higher tax rates. Remember, higher taxes mean larger withdrawals and less money staying invested. -

![]()

How to Save with Betterment

Believe it or not, there is an art to saving money. Here are Betterment’s tips on how you ...