Betterment's Recommended Allocation Methodology

Betterment helps you meet your goals by providing allocation advice. Our allocation methodology and the assumptions behind it are worth exploring.

When you sign up with Betterment, you can set up investment goals you wish to save towards. You can set up countless investment goals. While creating a new investment goal, we will ask you for the anticipated time horizon of that goal, and to select one of the following goal types.

- Major Purchase

- Education

- Retirement

- Retirement Income

- General Investing

- Safety Net

Betterment also allows users to create cash goals through the Cash Reserve offering, and crypto goals through the Betterment Crypto Investing offering. These goal types are outside the scope of this allocation advice methodology.

For all investing goals (except for Safety Nets) the anticipated time horizon and the goal type you select inform Betterment when you plan to use the money, and how you plan to withdraw the funds (i.e. full immediate liquidation for a major purchase, or partial periodic liquidations for retirement). Safety Nets, by definition, do not have an anticipated time horizon (when you set up your goal, Betterment will assume a time horizon for Safety Nets to help inform saving and deposit advice, but you can edit this, and it does not impact our recommended investment allocation). This is because we cannot predict when an unexpected emergency expense will arise, or how much it will cost.

For all goals (except for Safety Nets) Betterment will recommend an investment allocation based on the time horizon and goal type you select. Betterment develops the recommended investment allocation by projecting a range of market outcomes and averaging the best-performing risk level across the 5th-50th percentiles. For Safety Nets, Betterment’s recommended investment allocation is formed by determining the safest allocation that seeks to match or just beat inflation.

Below are the ranges of recommended investment allocations for each goal type.

| Goal Type | Most Aggressive Recommended Allocation | Most Conservative Recommended Allocation |

|---|---|---|

| Major Purchase | 90% stocks (33+ years) | 0% stocks (time horizon reached) |

| Education | 90% stocks (33+ years) | 0% stocks (time horizon reached) |

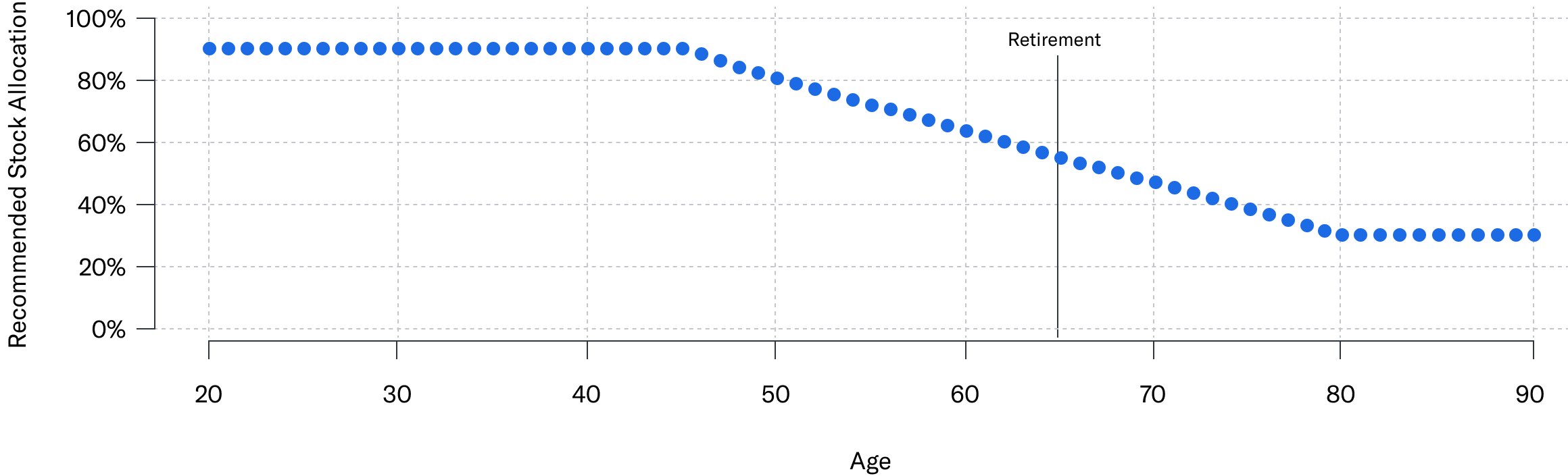

| Retirement | 90% stocks (20+ years until retirement age) | 56% stocks (retirement age reached) |

| Retirement Income | 56% stocks (24+ years remaining life expectancy) | 30% stocks (9 years or less remaining life expectancy) |

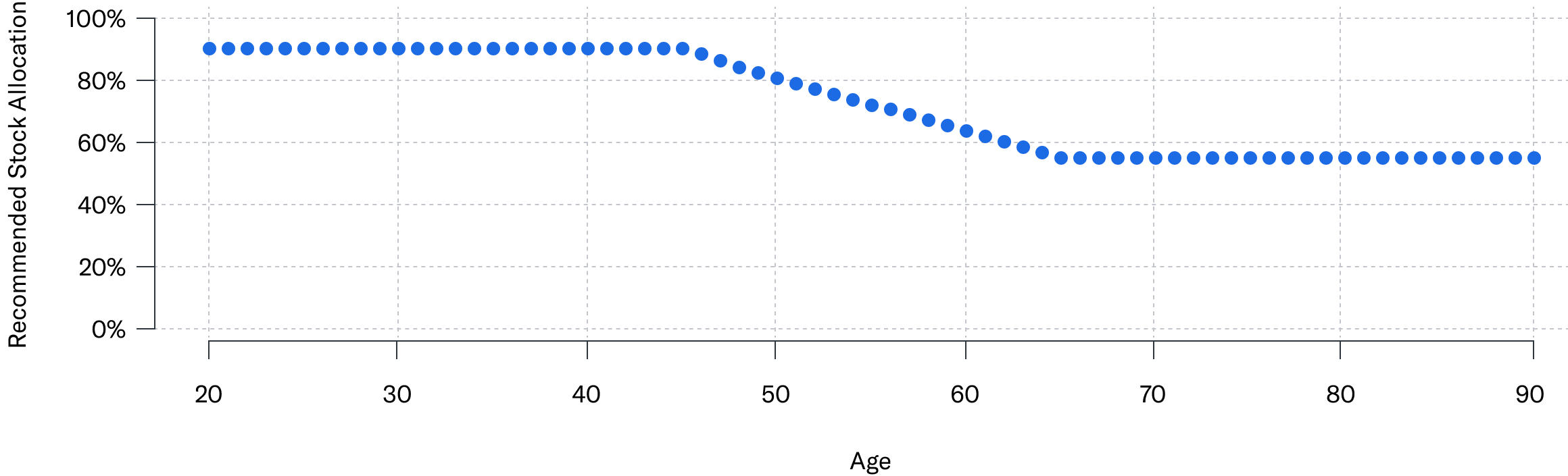

| General Investing | 90% stocks (20+ years) | 56% stocks (time horizon reached) |

| Safety Net | Safest allocation that seeks to match or just beat inflation | Safest allocation that seeks to match or just beat inflation |

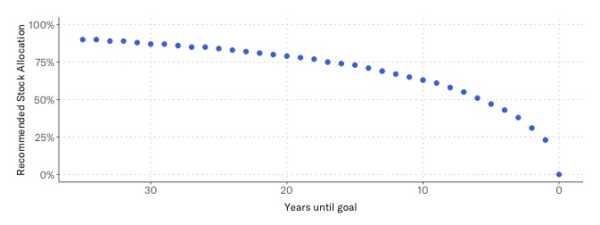

As you can see from the table above, in general, the longer a goal’s time horizon, the more aggressive Betterment’s recommended allocation. And the shorter a goal’s time horizon, the more conservative Betterment’s recommended allocation. This results in what we call a “glidepath” which is how our recommended allocation for a given goal type adjusts over time.

Below are the full glidepaths when applicable to the goal types Betterment offers.

Major Purchase/Education Goals

Retirement/Retirement Income Goals

Figure above shows a hypothetical example of a client who lives until they’re 90 years old. It does not represent actual client performance and is not indicative of future results. Actual results may vary based on a variety of factors, including but not limited to client changes inside the account and market fluctuation.

Figure above shows a hypothetical example of a client who lives until they’re 90 years old. It does not represent actual client performance and is not indicative of future results. Actual results may vary based on a variety of factors, including but not limited to client changes inside the account and market fluctuation.

General Investing Goals

Betterment offers an “auto-adjust” feature that will automatically adjust your goal’s allocation to control risk for applicable goal types, becoming more conservative as you near the end of your goals’ investing timeline. We make incremental changes to your risk level, creating a smooth glidepath.

Since Betterment adjusts the recommended allocation and portfolio weights of the glidepath based on your specific goals and time horizons, you’ll notice that “Major Purchase” goals take a more conservative path compared to a Retirement or General Investing glidepath. It takes a near zero risk for very short time horizons because we expect you to fully liquidate your investment at the intended date. With Retirement goals, we expect you to take distributions over time so we will recommend remaining at a higher risk allocation even as you reach the target date.

Auto-adjust is available in investing goals with an associated time horizon (excluding Safety Net goals and the BlackRock Target Income portfolio) for the Betterment Core portfolio, SRI portfolios, Innovation Technology portfolio, and Goldman Sachs Smart Beta portfolio. If you would like Betterment to automatically adjust your investments according to these glidepaths, you have the option to enable Betterment’s auto-adjust feature when you accept Betterment’s recommended allocation. This feature uses cash flow rebalancing and sell/buy rebalancing to help keep your goal’s allocation inline with our recommended allocation.

Adjusting for Risk Tolerance

The above investment allocation recommendations and glidepaths are based on what we call “risk capacity” or the extent to which a client’s goal can sustain a financial setback based on its anticipated time horizon and liquidation strategy. Clients have the option to agree with this recommendation or to deviate from it.

Betterment uses an interactive slider that allows clients to toggle between different investment allocations (how much is allocated to stocks versus bonds) until they find the allocation that has the expected range of growth outcomes they are willing to experience for that goal given their tolerance for risk. Betterment’s slider contains 5 categories of risk tolerance:

- Very Conservative: This risk setting is associated with an allocation that is more than 7 percentage points below our recommended allocation to stocks. That’s ok, as long as you’re aware that you may sacrifice potential returns in order to limit your possibility of experiencing losses. You may need to save more in order to reach your goals. This setting is appropriate for those who have a lower tolerance for risk.

- Conservative: This risk setting is associated with an allocation that is between 4-7 percentage points below our recommended allocation to stocks. That’s ok, as long as you’re aware that you may sacrifice potential returns in order to limit your possibility of experiencing losses. You may need to save more inorder to reach your goals. This setting is appropriate for those who have a lower tolerance for risk.

- Moderate: This risk setting is associated with an allocation that is within 3 percentage points of our recommended allocation to stocks.

- Aggressive: This risk setting is associated with an allocation that is between 4-7 percentage points above our recommended allocation to stocks. This gives the benefit of potentially higher returns in the long-term but exposes you to higher potential losses in the short-term. This setting is appropriate for those who have a higher tolerance for risk.

- Very Aggressive: This risk setting is associated with an allocation that is more than 7 percentage points above our recommended allocation to stocks. This gives the benefit of potentially higher returns in the long-term but exposes you to higher potential losses in the short-term. This setting is appropriate for those who have a higher tolerance for risk.